Was your Florida homeowners insurance claim denied? Homeowners insurance is designed to protect you from financial losses in the event that your home is damaged or destroyed. However, many Florida homeowners do not realize that their policy does not cover all types of damage.

For example, most policies do not cover damage caused by flooding. And if you live in a hurricane-prone area, your policy may not cover damage from high winds or hail.

It is important to read your policy carefully and understand what is and is not covered. This will help ensure that you are fully protected in the event of a disaster.

The Cliff Notes: Key Takeaways From This Post

We wanted to guide you on the steps to take if your homeowners insurance claim was denied; however, here are the key bullet points if you are in a rush:

- Insurance companies in Florida can make costly mistakes when denying home insurance claims.

- Reasons for incorrect denials may include leaving out important information or misinterpreting policy details.

- Homeowners should review their policy carefully to understand what is and isn’t covered by the policy. Common exclusions include flooding, earthquakes/ground movement, mold, pests/infestations, aggressive pets, and neglect/poor maintenance.

- If a claim is incorrectly denied, homeowners should have all the evidence they can to prove their case and contact the insurance company again.

- For cases where the evidence isn’t enough, hiring a public insurance adjuster or an experienced insurance dispute attorney may be able to get homeowners a better settlement than on their own.

Insurance Companies Make Mistakes Too

Insurance companies in Florida make mistakes just like regular people do. However, their mistakes can be far more costly. When this happens, the company not only risks alienating the policyholder but also faces the potential for a lawsuit.

There are a number of reasons why an insurance company might mistakenly deny a home insurance claim.

One reason is that the company might not have all of the information it needs to make a decision. For example, the company might not have received all of the necessary documentation from the policyholder.

Another reason might be that the company has incorrectly interpreted the policy. For example, the company might believe that a particular incident is not covered by the policy when in fact it is.

Did Your Insurance Company Get The Facts Of Your Claim Wrong?

When the Francis family filed their home insurance claim in Florida, they were confident that they would be able to get back on their feet after their house caught fire. Unfortunately, the insurance company denied their claim, stating that the damage was not covered under the policy.

The Francis family was devastated. They had lost everything in the fire and now they were not going to be able to rebuild their home. They tried to appeal the decision, but the insurance company refused to budge.

It turned out that the insurance company had gotten the facts of the case wrong. The fire had started when a candle overturned and the company had ruled that it was an act of arson, which was not covered by the policy. However, it was later determined that the fire was actually an accident and should have been covered by the policy.

Review Your Homeowners Insurance Policy Carefully

Homeowners in Florida should carefully review their insurance policy to ensure that they are aware of what is and is not covered in the event of a claim. If their insurance claim gets denied, they may be left responsible for the damages.

The following are some of the most common exclusions that might not be covered by your homeowners insurance policy in Florida:

Flooding

Homeowners insurance does not cover damage from occurrences like flooding, rain storms, sewer line backups, or water seepage from the ground that damages the home’s foundation. However, water damage from a burst pipe or a broken water heater is typically covered.

Earthquakes & Ground Movement

The ground movement exclusion refers to more than just earthquakes. It includes things like land shock waves from earthquakes, tremors before and after volcanic eruptions (and earthquakes too), landslides, mudslides, sinkholes, and any other sinking or shifting earth movements.

This exclusion doesn’t apply however if your home experiences fire or explosion damage that was triggered by an earth movement. That type of damage would be covered under standard homeowners insurance policies.

Rats, Termites, & Other Infestations

Homeowners insurance is designed to cover the owner’s property from fire, theft and other losses. However when it comes to animals like rats or termites; homeowners policies do not provide coverage for these types of infestations in almost all circumstances. There are extremely rare situations where the damage caused by an infestation could end up being covered by the policy. Say, for instance, a termite infestation causes part of your house to collapse. This damage may be covered under the “collapse” portion of a homeowners policy’s additional coverage section.

Mold

Homeowners insurance policies typically exclude mold damage from coverage. This means that if your home sustains mold damage, your insurance policy will not pay for the repairs. mold damage is often caused by excess moisture, so it’s important to take steps to prevent mold growth in your home.

However, even if you take all the necessary precautions, mold can still sometimes occur. If you do find mold in your home, it’s important to act quickly to remove it. Mold removal can be expensive, so check with your insurance company to see if they offer any coverage for mold removal. Even if they don’t, it’s important to get rid of the mold as soon as possible to prevent further damage to your home.

Aggressive Pets

Dog bites can be serious injuries that require extensive medical treatment, so you might assume that your homeowners insurance would cover the costs. However, many policies include an exclusion for dog bites, which means that you would have to pay out of pocket for any resulting medical expenses.

The reason for this exclusion is that certain dog breeds have a history of aggression, and the insurance company views them as a higher risk. As a result, they are less likely to provide coverage in the event of a dog bite claim.

For owners with dogs that fall under this more aggressive classification, it’s important to be aware of this exclusion in your policy. That way, you can make sure you have the financial resources in place to cover any resulting medical expenses.

Owner Neglect Or Poor Maintenance

Most homeowners policies in Florida exclude damage caused by poor maintenance or neglect from the homeowner. This is because such damage is considered preventable and, as such, the responsibility of the homeowner to fix.

For example, if a pipe bursts due to a build-up of limescale, the resulting water damage would not be covered by insurance as it could have been prevented with regular maintenance. The same goes for damage caused by a leaky roof or overflowing gutters; both are typically excluded from homeowners insurance policies.

By understanding what is and isn’t covered by your policy, you can help to prevent costly surprises down the road.

Make Sure You Have Gathered All The Evidence You Can

If you have reviewed your Homeowners insurance policy carefully and believe your claim should still be covered, then take the time to carefully gather all of the evidence you can.

This includes photos, videos, repair estimates, and receipts for any purchases made due to the property damage in question. It is important to have this documentation in order to prove to the insurance company that the claim is legitimate. Without this evidence, homeowners will have a difficult time getting the insurance company to reverse its decision.

Contact Your Insurance Company Again

If you carefully reviewed your policy and still think that your claim was mistakenly denied, you should contact your insurance company again.

If you have new evidence that could affect your claim, or the adjuster who reviewed it miscalculated and undervalued what was damaged or lost during an event (which is possible), then ask them if they’ll reevaluate everything based on tighter criteria.

Keep in mind that insurance companies are not required to re-evaluate a claim, even if new evidence is submitted.

Your insurance company may believe that the new evidence does not change the outcome of the claim. For example, if the homeowners were originally denied coverage because they did not have enough documentation, submitting additional documentation may not be enough to get the claim approved.

Additionally, the insurance company may decide not to improve its settlement offer, even if the new evidence suggests that it should. If this happens to you, then you should consider hiring a public insurance adjuster to get an independent opinion of what your claim is worth.

Hire a Public Insurance Adjuster

If your insurance company has refused to re-evaluate your claim or offered an amount that is lower than what you need to repair the damage, you should consider hiring a public insurance adjuster.

Public insurance adjusters are licensed professionals who work on behalf of homeowners in Florida to negotiate with insurance companies. They will review your policy, inspect the damage, and gather evidence to support your claim.

In many cases, they are able to get homeowners a higher settlement than they would have received on their own. If you are struggling to pay for repairs after your home has been damaged, a public insurance adjuster may be able to help you get the money you need.

File a Complaint With The Florida Department Of Financial Services

Florida homeowners can file a consumer complaint with the Department of Financial Services. This is the department that oversees the Department of Insurance in Florida.

Filing a consumer complaint is one way to get the attention of lawmakers in Tallahassee and could also end up helping other homeowners if this is a widespread bad practice.

To file a complaint, you can call the consumer helpline at 1-877-693-5236 or visit the online insurance assistance homepage.

Here’s what you need to provide in order to get a response from the Department of Consumer Services:

- Home insurance policy number

- Full name of your insurance company

- Claim number

- A paragraph explaining why you are filing this complaint (keep in mind this will be public record, so be polite and concise)

- You can also include scanned copies of your denial letter or other evidence with your submission

After submitting this complaint, the insurance company will be notified and they will be required to respond to a representative at the Department of Consumer Services within 20 days.

This process does not require an attorney, although our attorneys are happy to help explain the process in greater detail if you would like to reach out to us.

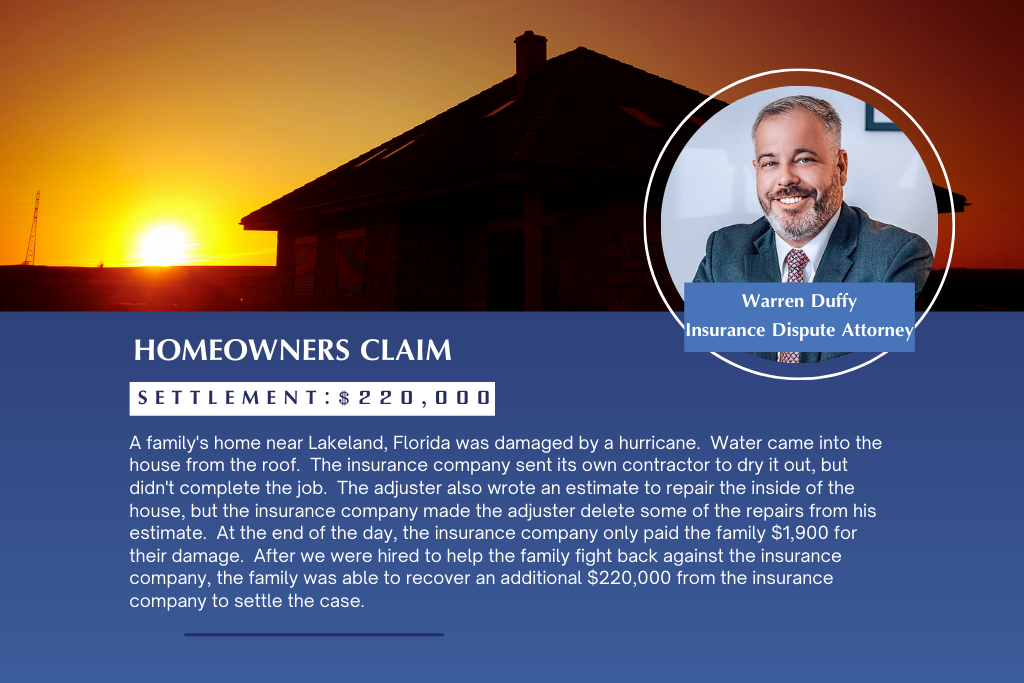

Hire An Experienced Insurance Dispute Attorney

Homeowners who have had their insurance claim denied may feel like they are up against a wall. After all, the insurance company has adjusters and attorneys on their side, working to pay out as little as possible.

Facing that on your own can be daunting, but homeowners shouldn’t give up. An experienced insurance dispute attorney can level the playing field, and may even be able to get the homeowners a better settlement than they would have been able to get on their own.

The insurance dispute attorneys at Herman & Wells are experts when it comes to Florida’s insurance laws and the tactics adjusters and insurance providers use. We will advocate on your behalf to get you the compensation you deserve to repair your home. We also offer free claim reviews, so Florida homeowners should not hesitate to call (727) 821-3195 if they find themselves in this situation.