Tampa Insurance Dispute Attorneys

“Not only did Attorney Herman call me back right away, but he took the time to answer my (many) questions and he gave me enough good information for me to be able to make an informed decision. Prior to contacting this firm I did my due diligence and watched his video explaining how Citizens only wanted to give his former client $1,000 and he ended up winning $300,000 for his client. I also investigated and found out that Attorney Herman is listed on Superlawyers.com. He treated me with respect, professionalism, and genuinely cared about my well-being and me being able to do what is best for me and my family first. I was truly impressed and would recommend him to anyone that I care about.”

Cyber J

Contact us for a free case evaluation

By submitting my data I agree to be contacted

TABLE OF CONTENTS

- DO YOU NEED A LAWYER TO DISPUTE YOUR INSURANCE COMPANY’S DECISION?

- HOW CAN OUR TAMPA INSURANCE DISPUTE ATTORNEYS HELP YOU?

- WHAT TYPES OF CLAIMS CAN OUR TAMPA INSURANCE DISPUTE ATTORNEYS HELP WITH?

- COMMON REASONS INSURANCE CLAIMS ARE DENIED IN TAMPA

- DO YOU HAVE A BAD FAITH INSURANCE CLAIM IN TAMPA?

- SIGNS YOUR INSURANCE AGENT MAY HAVE ACTED NEGLIGENTLY

- BEST TIME TO CONSULT AN INSURANCE DISPUTE ATTORNEY IN TAMPA

- WHAT IS OUR LAW FIRM’S PROCESS FOR INSURANCE DISPUTE CASES IN TAMPA

- TIMELINE FOR PROPERTY DAMAGE INSURANCE CLAIMS IN TAMPA

- CONTACT OUR TAMPA INSURANCE DISPUTE LAWYERS

WHAT HAPPENED?

If your insurance company is treating you unjustly, it’s time to find a good insurance dispute attorney in Tampa. Any type of dispute with an organization like this can be extremely complex, and the consequences of not having the right representation can be devastating. Fortunately, there are some excellent Tampa insurance dispute attorneys working for Herman & Wells.

Our insurance dispute team has decades of experience advocating for policyholders like you when their insurance company decides not to have their back. It’s important to note that you have the right to a second opinion in regard to your claim, and you have the right to dispute an unjust decision without the fear of being dropped by your provider.

Contact our Tampa insurance dispute attorneys at (727) 821-3195 for a free consultation. It’s time to take action and we’d like the opportunity to help you.

THE CLIFF NOTES

Get the key takeaways from this page

THE CLIFF NOTES

Get the key takeaways from this page

- Experienced Legal Support: Our law firm specializes in assisting Tampa policyholders with wrongfully denied or underpaid insurance claims.

- Expertise in Various Claims: We handle all types of insurance claims, from those involving property damage to those concerning personal injury claims.

- Bad Faith Insurance Claims: Our firm can help determine if your claim was handled in bad faith, such as through inadequate investigation or delayed payment.

- Negligent Insurance Agents: Our attorneys will assess if an insurance agent acted negligently, like failing to disclose important policy details or giving poor advice.

- Suing Insurance Companies: We will guide when and how to sue an insurance company for denying a claim.

- Client-Centric Approach: Our lawyers work on a contingency basis and guide clients through the entire claim process, including litigation if necessary.

- Free Claim Review: Policyholders can contact Herman & Wells to book a free claim review with one of our experienced Tampa insurance claim lawyers.

DO YOU NEED A LAWYER TO DISPUTE YOUR INSURANCE COMPANY’S DECISION?

The answer to this question depends on the facts of your case. Many insurance companies will attempt to deny or minimize valid claims, and if you are not familiar with the insurance claim process, you may not know how to effectively challenge their decision. An experienced Tampa insurance dispute lawyer will know how to investigate your claim, gather evidence, and negotiate with the insurance company to get you the compensation you deserve.

HOW CAN OUR TAMPA INSURANCE DISPUTE ATTORNEYS HELP YOU?

If you are involved in an insurance dispute, our Tampa insurance dispute attorneys can help. We have experience handling all types of insurance disputes, from those involving property damage to those concerning personal injury claims. We will work tirelessly to ensure that you receive the compensation you deserve.

WHAT TYPES OF CLAIMS CAN OUR TAMPA INSURANCE DISPUTE ATTORNEYS HELP WITH?

Wrongfully Denied, Underpaid, Or Closed a Legitimate Claim?

If your insurance company has denied, underpaid, or closed your legitimate claim, you may have a right to take legal action. The Tampa insurance dispute attorneys at Herman & Wells are here to help you get the full and fair compensation you deserve.

We understand the complex laws and regulations governing insurance companies in Florida. Our clients turn to us to dispute their denied, underpaid, or closed claims. We have represented policyholders in a wide range of insurance disputes, including:

Property Damage Claims

If you have ever suffered property damage and needed to make an insurance claim, you know how important it is to have a good lawyer on your side. The attorneys at Herman & Wells are experienced in dealing with property damage insurance disputes and can help you get the most out of your claim. We will work diligently to make sure that you receive the compensation you deserve for all of the damage that has been done to your property.

Homeowners Insurance Claims

Homeowners with insurance claims can have very frustrating experiences with their insurance companies. Sometimes an insurance company will pay for damage at one home and deny exactly the same damage for a neighbor. Adjusters go silent on homeowners and the money needed to make repairs isn’t provided.

The insurance dispute lawyers at our firm have represented Tampa homeowners against their insurance companies when claims were denied or short-paid, obtaining settlements that allowed those homeowners to put their houses back together.

Commercial Insurance Claims

Commercial insurance is a vital part of any business. It provides protection against losses that can occur due to events such as property damage, theft, or liability claims. When a claim arises, it’s important to have an experienced attorney who can help you navigate the complex legal process and get the best possible outcome for your business.

That’s where the Tampa insurance dispute attorneys at Herman & Wells come in. We have decades of experience dealing with all types of commercial insurance disputes, and we know how to get results. Contact us today for a free consultation!

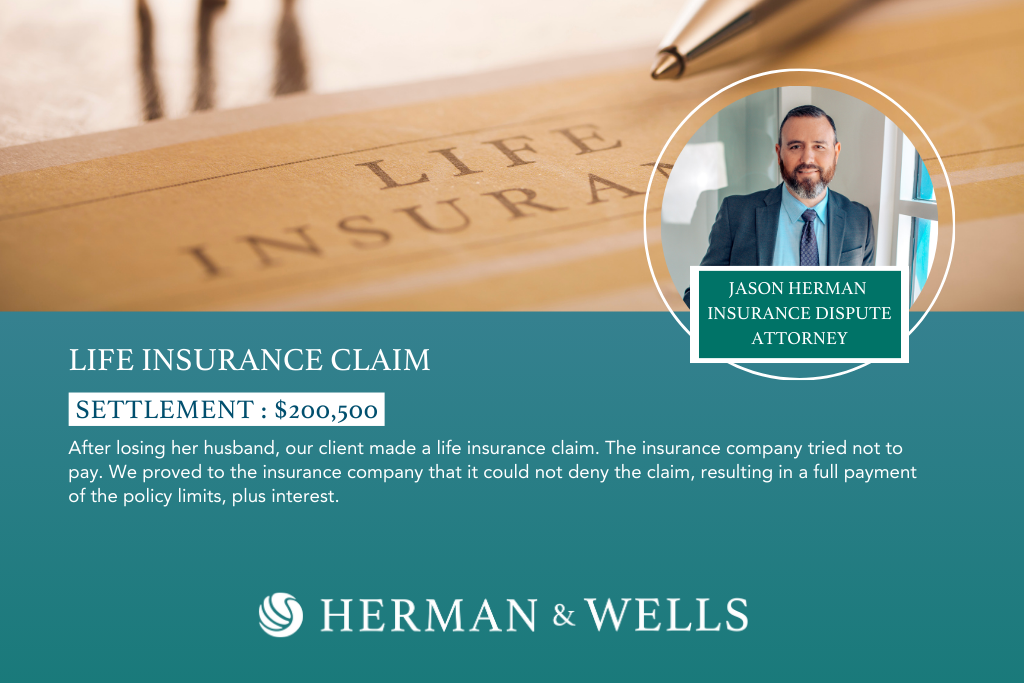

Life Insurance Claims

When you buy life insurance, that represents a contract with your insurance provider. In exchange for regular premiums, the company agrees to pay your beneficiaries a sum of money upon your death. This money is supposed to help your loved ones cover funeral expenses and other costs associated with your death.

If a valid life insurance claim is unjustly denied or underpaid, you should take action as soon as you can.

Contact our Tampa insurance dispute attorneys. We’ll go through your policy and explain your rights under it. We have the skills and resources to take your life insurance company to court if necessary to get the compensation you are owed for a life insurance claim.

COMMON REASONS INSURANCE CLAIMS ARE DENIED IN TAMPA

If you have to make a significant insurance claim to make, it is important to keep in mind that insurance companies are for-profit businesses. As such, they often look for ways to deny claims or minimize payouts. There are many reasons why an insurance company may deny a claim.

Some of the most common reasons include:

Failure To Prove Damages

In order to recover damages from an insurance company, you must be able to prove the extent of your damages. This can be difficult to do without the help of an experienced insurance dispute attorney.

Pre-Existing Conditions

Many insurance policies exclude coverage for pre-existing conditions. If you have a pre-existing condition that was not disclosed to the insurance company, they may deny your claim.

Incorrect Or Incomplete Information

Insurance companies often deny claims based on incorrect or incomplete information. If you provide the insurance company with inaccurate information, they may use it to deny your claim.

Denial Of Coverage

Insurance companies may also deny coverage for certain types of damages. For example, some policies do not cover property damage caused by flooding.

If you have been involved in an accident and your insurance claim has been denied, the Tampa insurance dispute attorneys at Herman & Wells can help. We will review your policy and determine why your claim was denied and work to reopen your claim.

DO YOU HAVE A BAD FAITH INSURANCE CLAIM IN TAMPA?

A bad faith insurance claim is a situation where an insurance company denies a claim or pays it only a fraction of what is owed, knowing it is not in compliance with the policy. This could be due to the insurance company refusing to investigate the claim fully, refusing to pay for damages, or delaying payment.

To learn whether or not you have a bad faith insurance claim, you should speak with an experienced Tampa insurance dispute attorney.

SIGNS YOUR INSURANCE AGENT MAY HAVE ACTED NEGLIGENTLY

One way to tell if an insurance agent may have acted negligently is if they are not able to provide you with the specific details of your policy. This could mean that they didn’t take the time to read through it or that they didn’t understand what was written. If you have had any issues filing a claim or getting the money you’re owed, this may also be a sign of negligence on the agent’s part.

An insurance agent may have acted negligently if they fail to properly investigate a claim. For example, an insurance company may dispute a claim if the policyholder does not provide enough information. If the insurance company does not properly investigate the claim, they may end up denying it unnecessarily. This could be considered negligence on the part of the insurance company.

If you’re unsure about whether or not your agent acted negligently, you can always consult with a Tampa insurance dispute attorney. They will be able to review your case and let you know if you have a valid claim against your agent.

BEST TIME TO CONSULT AN INSURANCE DISPUTE ATTORNEY IN TAMPA

No one wants to deal with an insurance dispute, but sometimes it is unavoidable. If you find yourself in this situation, it is best to consult an attorney as soon as possible. An insurance dispute attorney can help you understand your rights and guide you through the insurance claim process. They will also be able to negotiate on your behalf and help you get the best possible outcome.

WHAT IS OUR LAW FIRM’S PROCESS FOR INSURANCE DISPUTE CASES IN TAMPA

We understand how stressful it may be to deal with an insurance company when they deny or underpay your claim. From the first contact with a potential client, our goal is to try to help reduce that stress and provide the best options for moving forward.

WHAT IS OUR LAW FIRM’S PROCESS FOR INSURANCE DISPUTE CASES IN TAMPA

We understand how stressful it may be to deal with an insurance company when they deny or underpay your claim. From the first contact with a potential client, our goal is to try to help reduce that stress and provide the best options for moving forward.

How We Work With Our Clients

When someone calls us with an insurance issue, we talk to them about what happened and get some key information like:

- What caused the loss or damage?

- What repairs have been made and what are left to be made?

- Who is the insurance company?

- What was the claim decision (denied? underpaid? no decision at all?)?

- What’s the timeline on the claim (when did the loss happen, when was it reported, and what has the insurance company done since then)?

- If we think we can help get a better result, we’re hired on a contingency basis–meaning we get paid out of whatever we recover from the insurance company, not out of our client’s pocket.

We then will gather important documents and other evidence, hire any expert witnesses (like engineers and contractors) needed, and give the client our take on their case when we have all of the information, as well as our recommendations on whether and when to sue or settle.

If the case can’t be resolved without a lawsuit, we explain the litigation process to our client and, once everyone is on the same page, we file the lawsuit papers with the court. We have experience fighting insurance companies all the way through trial, but most cases settle during the course of a lawsuit short of a trial.

During the entire process, we make sure the client knows what’s going on and why, what to expect, and continue to give advice about the case.

During the entire process, we make sure the client knows what’s going on and why, what to expect, and continue to give advice about the case.

TIMELINE FOR PROPERTY DAMAGE INSURANCE CLAIMS IN TAMPA

If you have filed a property damage insurance claim in Tampa, Florida, you may be wondering what the timeline for such claims typically looks like. Here is a general overview of what you can expect:

- The insurance company will have 30 days to acknowledge your claim.

- Once acknowledged, the insurer has 90 days to complete their investigation and either deny or approve your claim.

- If the insurance company denies your claim, they must provide you with a written explanation of their decision.

- If the insurance company approves your claim, they will issue a payment for the damages sustained.

Of course, every insurance company and every claim is different, so this timeline is not set in stone. However, it should give you a general idea of what to expect after filing a property damage insurance claim in Tampa, Florida.

If you have any questions about your specific claim, or if you need help filing a claim, the experienced Tampa insurance dispute attorneys at Herman & Wells can assist you.

How Long Do Home Insurance Claims Take To Settle?

If you’re involved in a home insurance dispute, you may be wondering how long the process will take to settle. Unfortunately, there is no one answer to this question as each case is unique and will likely have different timelines. However, understanding the typical process that home insurance claims go through can give you a general idea of how long your particular claim might take.

The first step in any home insurance claim is to notify your insurer of the incident. This can be done by calling your agent or filing a claim online. Once your insurer has been notified, they will open an investigation into the matter. During this investigation, they will likely request documentation from you such as police reports or medical bills. They may also send an adjuster to your home to assess the damage.

After the investigation is complete, your insurer will make a determination on whether or not they will cover the claim. If they deny the claim, you have the option to appeal their decision. However, if they approve the claim, they will provide you with a payout amount. At this point, you can either accept the payout or negotiate for a higher amount.

If you’re involved in a home insurance dispute, it’s important to understand that the process can take some time to resolve. However, working with an experienced attorney can help ensure that your claim is handled efficiently and effectively.

CONTACT OUR TAMPA INSURANCE DISPUTE LAWYERS

If you have had an insurance claim denied, it is important to speak with an experienced Tampa insurance dispute lawyer. We can review your policy and determine why your claim was denied. We will fight to reopen your claim and get you the compensation you deserve.

Contact our insurance dispute attorneys at Herman & Wells at (727) 821-3195 today for a free case review.

CONTACT OUR TAMPA INSURANCE DISPUTE LAWYERS

If you have had an insurance claim denied, it is important to speak with an experienced Tampa insurance dispute lawyer. We can review your policy and determine why your claim was denied. We will fight to reopen your claim and get you the compensation you deserve.

Contact our insurance dispute attorneys at Herman & Wells at (727) 821-3195 today for a free case review.

By submitting my data I agree to be contacted