Tampa Fire Damage Insurance Lawyers

“Attorney Warren Duffy responded to me. Warren is easy to work with – he listens; he explains everything in detail; he is reachable by phone and he responds to emails within hours. After his initial non-responsive contacts with the insurance company, we filed a lawsuit. Warren was able to skillfully negotiate a settlement without a lengthy court process; and I received a final check (net after fees) larger than the amount I had initially expected! Needless to say, should I have any future legal needs, I will immediately call Warren.”

Rob B

Contact us for a free case evaluation

By submitting my data I agree to be contacted

TABLE OF CONTENTS

- COMMON CAUSES OF FIRE DAMAGE IN FLORIDA

- UNDERSTANDING FIRE DAMAGE INSURANCE IN TAMPA

- STEPS TO TAKE FOLLOWING FIRE DAMAGE IN TAMPA

- HOW LONG DO I HAVE TO FILE AN INSURANCE CLAIM AFTER A FIRE IN TAMPA?

- WHAT TO DO IF YOUR FIRE DAMAGE INSURANCE CLAIM DENIED?

- COMMON REASONS FOR DENIED FIRE DAMAGE INSURANCE CLAIM

- HOW TO FIND THE RIGHT FIRE DAMAGE INSURANCE LAWYER FOR YOUR CLAIM

- CONTACT OUR TAMPA FIRE DAMAGE INSURANCE LAWYERS

WHAT HAPPENED?

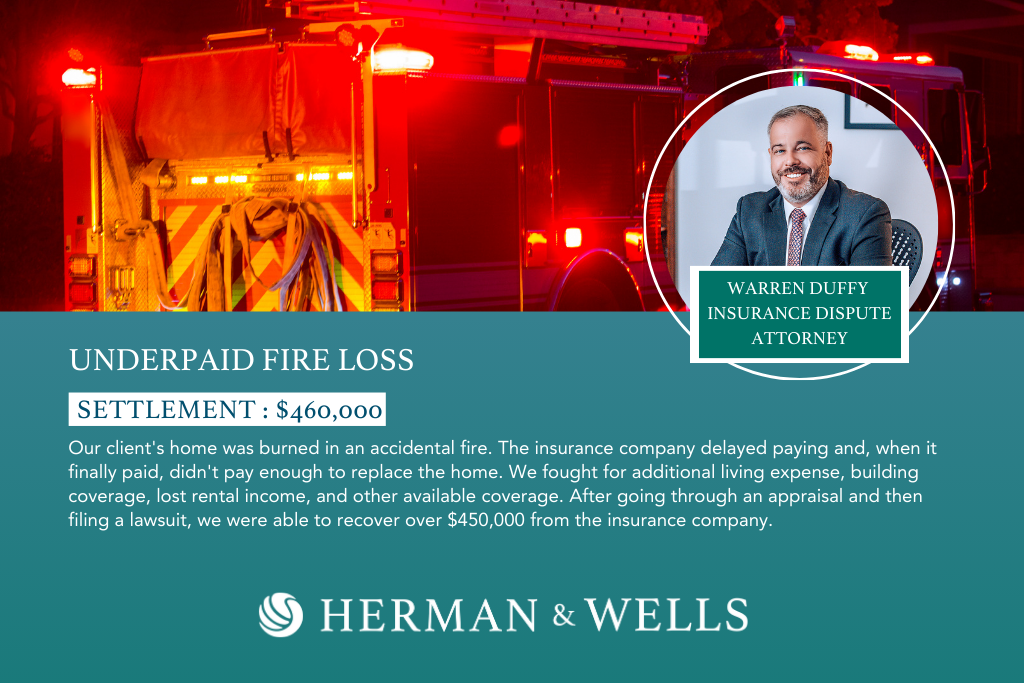

If you’ve suffered property damage due to a fire in Tampa, Florida, navigating the complexities of your fire damage insurance claim can be daunting. At this challenging time, the expertise of seasoned Tampa Fire Damage Insurance Lawyers can be invaluable. Our dedicated legal team understands the intricacies of fire damage insurance claims and is committed to helping you secure the maximum compensation you are entitled to.

Don’t navigate this complex process alone. Book a consultation with one of our Tampa fire damage insurance lawyers today.

At Herman & Wells, we pride ourselves on providing personalized service for each and every insurance claim. We understand that every fire damage case is unique, with its own set of circumstances, challenges, and needs. Our approach is tailored to fit these unique needs, and we work closely with you to understand your specific situation.

We keep you informed at every stage of the process, explaining the complex insurance jargon in simple terms, and making sure that you understand the implications of each decision. This personalized approach ensures that we build a robust and effective case strategy, aimed at securing the maximum compensation that you are entitled to.

THE CLIFF NOTES

Get the key takeaways from this page

THE CLIFF NOTES

Get the key takeaways from this page

- You must file a lawsuit within two years of fire loss for property insurance claims, including fire damage.

- Your policy may have its own specific deadlines. Always review your policy or consult with a professional to ensure you’re in full compliance.

- Common reasons for denied fire damage insurance claim include accidental omission or incorrect information in the application, non-disclosure of previous claims or losses, and more.

- When looking for a fire damage insurance lawyer in Tampa, Florida be sure to look for one with extensive experience with similar cases.

- Don’t let the intricacies of the claim process deter you, contact Herman & Wells for a free consultation with one of our experienced fire damage insurance lawyers today!

COMMON CAUSES OF FIRE DAMAGE IN FLORIDA

Some common causes of fire damage include:

Electrical Fires

Electrical fires are a common cause of fire damage in Florida. They are often triggered by faulty wiring, overloaded electrical outlets, or malfunctioning appliances. Regular inspection and maintenance of your home’s electrical system are crucial in preventing such incidents.

Cooking Fires

Cooking fires are another leading cause of fire damage. Unattended cooking, flammable objects near the stove, or malfunctioning cooking appliances can easily start a fire. Always pay attention when you’re cooking and keep your cooking area clean and free of flammable materials.

Lightning Strikes

Given Florida’s high incidence of lightning strikes, this natural phenomenon is a significant cause of fire damage in Tampa. Lightning, when it strikes a residential or commercial structure, can cause serious fires. Installing lightning rods and surge protectors can help reduce the risk.

Smoking-Related Fires

Smoking-related fires frequently occur when cigarettes are improperly extinguished or left unattended. These can be especially damaging if they ignite materials such as upholstery or bedding. The best prevention is to never smoke indoors or ensure cigarettes are fully extinguished.

Wildfires

Wildfires are a prevalent issue in Florida due to its climate and abundant vegetation. These fires can rapidly spread, causing widespread damage. Maintaining a defensible space around your property and following local fire safety regulations can mitigate the risk of wildfire damage.

UNDERSTANDING FIRE DAMAGE INSURANCE IN TAMPA

Basics Of Fire Damage Insurance

Fire damage insurance is a critical component of homeowners’ and property owners’ insurance policies in Tampa, Florida. This coverage is designed to help you financially recover from a disastrous fire event by compensating for the repair or replacement costs of your home and personal belongings damaged by fire.

Moreover, it may also cover additional living expenses if you’re displaced from your home due to fire damage. It’s essential to understand that fire damage insurance isn’t a luxury; it’s a necessity. Without it, you could face significant out-of-pocket expenses to restore your property to its pre-fire state, adding financial stress to an already challenging situation.

Tampa-specific Fire Insurance Challenges

Tampa’s susceptibility to natural disasters like hurricanes and wildfires, insurers may impose specific conditions or exceptions that could affect your fire damage claim. Navigating these regional complexities without professional assistance can lead to detrimental outcomes, underscoring the need for an experienced Tampa fire damage insurance lawyer.

STEPS TO TAKE FOLLOWING FIRE DAMAGE IN TAMPA

Immediate Actions Post-Fire

Immediately after a fire, your first priority should be ensuring everyone’s safety. Evacuate the premises promptly and call the local fire department. Once the fire is extinguished, inform your insurance company of the incident. This step is crucial as delaying this notification may impact your claim.

Documenting The Fire Damage

Accurate documentation of the damage caused by the fire is crucial for your insurance claim. Here are some tips for effectively capturing the extent of the damage:

- Photograph Everything. Take detailed photographs of all damaged areas and items. Capture multiple angles and close-ups to highlight the severity of the damage. If possible, compare these with pre-fire photos of the same items or areas.

- Make A Detailed Inventory. Prepare a comprehensive list of all damaged items, including their value and the cost to replace them. This list should also include items of significant value, such as jewelry, electronics, and artwork. Be as specific as possible – details like brand names, models, and purchase dates can help establish the value of the items.

- Keep Damaged Items. Don’t rush to dispose of damaged items. They serve as tangible proof of your loss. If safety permits, store these items until the insurance adjuster has assessed your claim.

- Collect Evidence of Financial Loss. Gather receipts, bank statements, or credit card statements that can validate the value of damaged items. For items where receipts are not available, consider obtaining professional appraisals.

- Report to the Fire Department. Request a copy of the fire report from your local fire department. This document provides an official account of the incident, including the cause of the fire, which can be valuable evidence for your claim.

Filing Your Insurance Claim

To file a fire damage insurance claim in Tampa, Florida, you should typically follow these steps:

- Contact your Insurance Company: Inform your insurance company about the fire incident as soon as it is safe to do so. Provide them with all necessary details and your policy number.

- Fill out Claim Forms: Your insurance company will provide claim forms which you need to complete accurately. Make sure to fill out all required sections diligently.

- Submit Evidence of Damage: Alongside the claim form, submit all the documentation you have collected.

- Cooperate with the Insurance Adjuster: An adjuster will visit your property to inspect the damage. Be cooperative and provide all necessary information.

- Review Settlement Offer: Your insurance company will provide a settlement based on the adjuster’s report. Review this offer carefully. If it doesn’t seem sufficient, don’t hesitate to negotiate.

Information to Include in Your Claim

In your claim form, ensure to include the following crucial information:

- Detailed description of the incident, including the date and time of the fire.

- A comprehensive list of damaged or lost items, including their value.

- Receipts or evidence of value for high-cost items.

- Your temporary living expenses if your home is uninhabitable.

- Any third-party liability, such as damage to a neighbor’s property.

- Detailed description of the incident, including the date and time of the fire.

- A comprehensive list of damaged or lost items, including their value.

- Receipts or evidence of value for high-cost items.

- Your temporary living expenses if your home is uninhabitable.

- Any third-party liability, such as damage to a neighbor’s property.

How Herman & Wells Can Support You

Navigating the intricacies of a fire damage claim can be overwhelming. Engaging Herman & Wells at the start of your claim process can significantly streamline your experience. Our legal experts can:

- Guide you through the claims process, ensuring you understand your rights and responsibilities.

- Help in documenting your losses and preparing a comprehensive claim form.

- Negotiate with the insurance company on your behalf, striving for a fair settlement.

- Represent you in court, if necessary, to secure the compensation you rightly deserve.

Remember, the aftermath of a fire can be a demanding time. Having our fire damage insurance lawyers on your side can help alleviate the stress, allowing you to focus on your recovery while we ensure you get the compensation you deserve.

HOW LONG DO I HAVE TO FILE AN INSURANCE CLAIM AFTER A FIRE IN TAMPA?

As per the recent changes, you must now file a lawsuit within two years of the loss for property insurance claims, including fire damage. This stringent timeline makes it even more critical to begin the claims process as quickly as possible post-fire.

HOW LONG DO I HAVE TO FILE AN INSURANCE CLAIM AFTER A FIRE IN TAMPA?

As per the recent changes, you must now file a lawsuit within two years of the loss for property insurance claims, including fire damage. This stringent timeline makes it even more critical to begin the claims process as quickly as possible post-fire.

It’s also important to note that your insurance policy may have its own specific deadlines. Always review your policy or consult with a professional to ensure you’re in full compliance.

WHAT TO DO IF YOUR FIRE DAMAGE INSURANCE CLAIM DENIED?

If your fire damage insurance claim has been denied, don’t despair. First, review the reason for denial given by your insurance company. Misunderstandings or clerical errors can often be rectified with a simple clarification or resubmission of documents. If the denial is due to a more complex issue, such as a dispute over the cause of the fire or the value of a claim, it may be necessary to seek professional help.

Engaging a skilled Tampa fire damage insurance lawyer like Herman & Wells can make a significant difference in such situations. We can help reassess your claim, gather additional evidence if needed, and advocate on your behalf to ensure your rights are upheld.

COMMON REASONS FOR DENIED FIRE DAMAGE INSURANCE CLAIM

Accidental Omission or Incorrect Information in the Application

One common reason for a claim denial is inaccuracies or omissions in the insurance application. These could be unintentional mistakes or miscommunications, but they can lead the insurance company to question your claim’s validity. It’s crucial to provide accurate and complete information when applying for insurance.

Non-disclosure of Previous Claims or Losses

Insurance companies consider your claim history when processing a new claim. If you’ve failed to disclose previous claims or losses, the company might deny your current claim on grounds of non-disclosure. Ensure that your claim history is fully disclosed when you apply for a policy.

Inadequate Maintenance or Upkeep of Property

Insurance companies may deny a fire damage claim if they determine the fire resulted from poor maintenance or neglect. Regular upkeep of your property, including fire safety measures, is vital to prevent such situations.

Suspicion of Fraud or Arson

In some cases, insurance companies may suspect fraud or arson, particularly if there are inconsistencies in the claim or if the fire’s cause is unclear. A thorough investigation is usually conducted in such cases. Therefore, it’s essential to provide clear and consistent information throughout your claim process.

Lack of Evidence or Inadequate Documentation

Providing solid evidence is key to a successful claim. If your claim lacks substantial evidence or if the damage is not adequately documented, the company may deny your claim. Following the fire, document all damage and losses meticulously to support your claim.

Delay in Reporting the Loss

Insurance policies typically require that losses be reported promptly. A delay in reporting the fire incident to your insurance company could result in a denied claim. It’s important to contact your insurance company as soon as possible after a fire to avoid this issue.

Remember, claim denial is not the end of the road. If you believe your claim has been unfairly denied, consider seeking legal assistance.

HOW TO FIND THE RIGHT FIRE DAMAGE INSURANCE LAWYER FOR YOUR CLAIM

Finding the right fire damage insurance lawyer for your claim in Tampa, Florida, is a crucial step in ensuring your rights are upheld. Look for a lawyer with extensive experience in handling fire damage claims, as this expertise will be invaluable in navigating the complexities of the insurance world.

Check their track record for successful settlements and court representations. Consultations or initial discussions should be transparent and informative, leaving you with a clear understanding of your situation and possible outcomes. Lastly, choose a lawyer who prioritizes your interests and advocates passionately on your behalf, like the team at Herman & Wells.

CONTACT OUR TAMPA FIRE DAMAGE INSURANCE LAWYERS

Dealing with a fire damage insurance claim in Tampa, Florida, can be challenging, but remember, you don’t have to face it alone. The team at Herman & Wells is committed to helping you navigate this complex process, ensuring your rights are upheld and facilitating a fair settlement.

Don’t let the intricacies of the claim process deter you. Take the first step towards safeguarding your rights today. Call (727) 821-3195 now to book a free consultation with one of our experienced fire damage insurance lawyers!

CONTACT OUR TAMPA FIRE DAMAGE INSURANCE LAWYERS

Dealing with a fire damage insurance claim in Tampa, Florida, can be challenging, but remember, you don’t have to face it alone. The team at Herman & Wells is committed to helping you navigate this complex process, ensuring your rights are upheld and facilitating a fair settlement.

Don’t let the intricacies of the claim process deter you. Take the first step towards safeguarding your rights today. Call (727) 821-3195 now to book a free consultation with one of our experienced fire damage insurance lawyers!

By submitting my data I agree to be contacted