If you’ve ever had an insurance company stall on your claim and it’s left you feeling frustrated and helpless, then this blog post is for you. Dealing with a stalling insurance company can be exhausting and confusing, but understanding the process behind their actions will help to equip you with the knowledge to face any adversity confidently.

Most importantly, though — don’t suffer alone! You are not without recourse and there are many options available if your insurer continues to drag out proceedings despite due cause.

If you’re in the midst of an insurance claim dispute, please contact our experienced insurance dispute lawyer in Florida today for a free consultation and to have your questions answered!

The Cliff Notes: Key Takeaways From This Post

- 1Mistakes in handling an insurance claim can lead to delays and a potentially unfair settlement.

- 2Understanding the reasons for insurance claim delays can help you prevent or address them effectively.

- 3Questionable practices by some Florida insurers have raised concerns about their integrity and the impact on policyholders.

- 4Effective communication, thorough knowledge of your policy, and seeking legal assistance when needed are crucial strategies in handling insurance claims.

- 5Signs that you may need a lawyer for your insurance claim include delays, denials without explanation, and unfair settlements.

- 6If you’re facing challenges with your insurance claim, do not hesitate to reach out to our team for professional legal assistance.

Understanding The Insurance Claim Process In Florida

Florida’s current insurance landscape is fraught with challenges for policyholders. Numerous insurance companies are working double-time, employing a range of tactics to avoid fair payout to policyholders. This has resulted in a widespread climate of distrust and frustration among those needing to make legitimate insurance claims.

Filing your insurance claim correctly from the beginning is crucial to prevent complications and delays. It’s also highly recommended to contact legal representation early on, as an experienced insurance dispute lawyer in Florida can help navigate through the complex process and tackle any unscrupulous practices by these companies. Your lawyer will serve as a formidable advocate, ensuring that your rights are protected and your claim is handled justly and promptly.

Steps To Filing A Florida Insurance Claim Correctly

Commencing the journey of filing an insurance claim can often seem daunting, especially when confronted with the prospect of negotiations with your insurer. To guide you through this critical process, we have outlined a systematic five-step approach designed to ensure that your claim is handled efficiently and your interests are adequately protected.

Step 1: Document Everything

Detailed documentation serves as a crucial foundation to your insurance claim. Take photographs, save receipts, and write down all relevant details pertaining to the incident. Such rigorous record-keeping will create a solid basis for your claim, and may expedite the process considerably.

Step 2: Report The Incident

Report the incident to your insurance company as soon as you can. Remember, prompt reporting can prevent potential disputes down the line.

Step 3: Review Your Insurance Policy

Take the time to review your insurance policy thoroughly to understand the kind of coverage it provides. Familiarize yourself with the stipulations, requirements, and potential exclusions in your policy.

Step 4: File Your Claim

After documenting the incident, reporting it to the company, and reviewing your policy, it’s time to file your claim. Ensure you include all pertinent details and documents alongside your claim to prevent any unnecessary delays or complications.

Step 5: Seek Legal Help

If your claim is being delayed or disputed without clear reason, it may be time to seek legal help. An experienced insurance dispute lawyer in Florida can provide crucial assistance, advocating for your rights, and ensuring your claim is handled fairly.

Common Mistakes To Avoid During The Insurance Claim Process

Mistake 1: Accepting The First Offer

One of the most common mistakes claimants make is accepting the first settlement offer from the insurance company. Remember, insurance companies are businesses first and their initial offers tend to be significantly lower than what you may be entitled to.

Mistake 2: Not Keeping A Record

Failing to keep a meticulous record of all your communications, documents, and evidence related to your claim can be detrimental. The burden of proof is on you, the policyholder, hence documenting everything meticulously is key.

Mistake 3: Misrepresenting Facts

Exaggerating or misrepresenting facts about your claim can lead to denial or delay in your claim process. Insurance companies have extensive experience and resources to investigate claims thoroughly. Always be truthful and transparent about the facts of your case.

Mistake 4: Ignoring Time Limits

Each insurance policy has specific time limits for reporting incidents, filing claims, and submitting additional documentation. Missing these deadlines can result in your claim being denied. Ensure you are aware of and abide by these timelines.

Mistake 5: Not Enlisting Professional Help

Handling an insurance claim on your own can be overwhelming and could result in you receiving less than you are entitled to. Engaging an experienced insurance dispute lawyer in Florida can help you navigate the complex insurance landscape, ensuring your rights are protected and you get a fair settlement.

Typical Reasons For Insurance Claim Delays

Insurance claim delays can occur due to several reasons, often stemming from discrepancies in documentation, investigation requirements, or simply due to the insurer’s tactics to avoid a fair payout. Understanding the common grounds for such delays can equip you with the knowledge to prevent them, or to identify when you might need to seek professional help.

Recent Insights On Questionable Practices By Florida Insurers

The Tampa Bay Times Report: A Closer Look

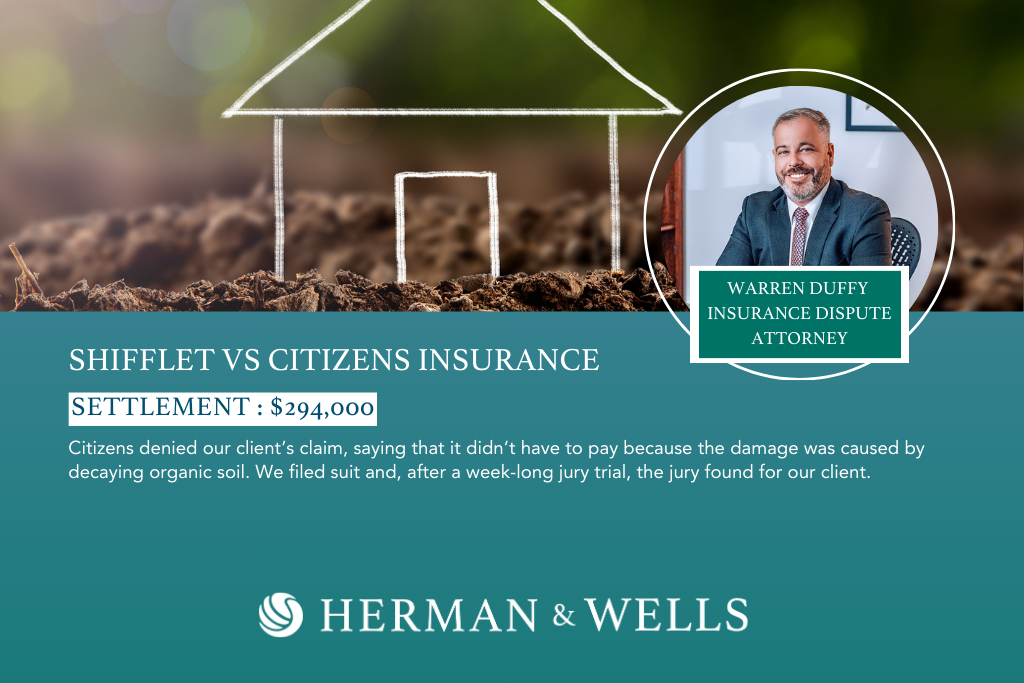

In a revealing report by the Tampa Bay Times, it was discovered that certain Florida insurers are allegedly engaging in questionable practices, including altering reports to deny rightful homeowners’ claims. The report further exposes that these companies are rapidly depleting their cash reserves, and making excessive payouts to their affiliated companies and high-ranking officers. This startling exposure has sent shockwaves throughout the industry, provoking serious concerns regarding the integrity of these companies. You can read the full story here.

The Impact On Florida Policyholders

The dubious practices of some Florida insurers have a significant impact on policyholders, often leaving them with denials of rightful claims or an unfair settlement. The dwindling cash reserves of these companies are raising doubts about their ability to honor future claims.

This situation not only undermines the trust in insurance providers but also adds to the financial strain on policyholders, who often find themselves grappling with unforeseen expenses and the complexities of insurance claim disputes. This emphasizes the importance of professional legal assistance in dealing with such issues.

Strategies To Combat Insurance Claim Delays

As you navigate the often complicated landscape of insurance claims in Florida, understanding how to effectively combat claim delays can be a game-changer in some cases.

Effective Communication With Your Insurer

Maintain clear, consistent, and documented communication with your insurer throughout the claim process. Whether it’s reporting the incident, discussing the status of your claim, or negotiating a settlement, make sure all communications are well-documented. This will serve as proof of your diligence and may come in handy if any disputes arise later.

Understanding Your Policy Thoroughly

A deep understanding of your insurance policy is crucial to prevent any surprises during the claim process. It is important to know what is covered, what is excluded, and what are the stipulations and deadlines in your policy. This knowledge will empower you to make informed decisions and prevent potential disputes.

When To Seek Legal Help In An Insurance Dispute

When the complexities of an insurance claim become overwhelming, or when an insurance company seems to be treating your claim unfairly, it might be time to take the legal route.

Signs That You May Need An Attorney For Your Insurance Claim

Certain signs may indicate that you need an attorney for your insurance claim. If your insurer is not responding in a timely manner, denying your claim without a clear explanation, or offering a settlement that you believe is unfair, these are potential signals that you should consult with a professional. An experienced insurance dispute lawyer in Florida can provide clarity on your rights, help negotiate a fair settlement, and ensure your claim is handled appropriately.

The Role Of “Insurance Dispute Lawyers”

Insurance dispute lawyers in Florida play a crucial role in protecting policyholders’ rights during insurance claim disputes. They bring in-depth legal knowledge and negotiation skills to the table, ensuring that your case is presented effectively and that you receive the settlement you’re entitled to. With an insurance dispute lawyer by your side, you can navigate the complexities of insurance claims with confidence and peace of mind.

Reach Out To Our Insurance Dispute Lawyers In Florida

Dealing with insurance disputes can be a stressful and complex process, but you don’t have to navigate it alone! Our team of experienced insurance dispute lawyers in Florida is dedicated to ensuring your rights are protected and that you receive the compensation you rightfully deserve.

Call (727) 821-3195 today to schedule a free consultation and let us help you secure a fair outcome in your insurance claim dispute!