Following a car accident in Florida, injured drivers and passengers could be facing significant expenses, including necessary medical fees, lost wages while recovering, and auto repairs. Florida is a no-fault state, so regardless of who was responsible for the car accident, you’ll need to file an accident claim with your insurance provider. For Florida drivers who are fortunate enough to not have needed to file a claim before (or only have ever filed minor property damage claims in the past), most assume it will be a pretty straightforward process.

Unfortunately, this is not always the case. Serious accidents represent a claim with a significant price point for insurance companies and the reality is that these are businesses that will look to save money however they can. The purpose of this post is to provide some insights into insurance company tactics that may be used when responding to a car accident claim in Florida.

At Herman & Wells, our personal injury attorneys are often contacted by people after they have filed their accident claim and are upset or frustrated with how things have proceeded. Some people end up in such a desperate situation that they are willing to accept any settlement offer their insurance provider makes. Most people in Florida need a working vehicle and the fee from just an ambulance ride and ER visit for your injuries could be over $10,000. We want to share these insights in hopes of showing more Floridians that they don’t need to settle for less, that they have other resources available to them.

The Cliff Notes: Key Takeaways From This Post

- 1In a no-fault state like Florida, your medical expenses and lost wages should be covered by your insurance company.

- 2To file a car accident claim in Florida, contact your insurance provider and fill out a police report.

- 3Insurance adjusters will consider actual expenses incurred, pain and suffering, policy limits, strength of the case, and more when determining the value of a claim.

- 4If your claim is denied or underpaid, you can appeal the decision or sue.

- 5Consult with an experienced personal injury lawyer if you need help navigating the claims process.

Whether you’ve just been in an accident or you’re currently contending with your insurance provider, consider calling an experienced personal injury lawyer like Clifford Wells. Herman & Wells offers a free initial consultation for exactly this scenario. While this post covers the basics of the insurance claims process and insights into how insurance companies may respond to these claims, it doesn’t compare to what you can learn from talking to an expert like Cliff.

You can call our firm directly at (727) 821-3195 to get connected with an attorney or use our online form to request a free initial consultation at your earliest convenience.

Insurance Claims Process Basics in a No-Fault State

First, you must understand how the claims process in your area works. In most states, the insurance company that insured the person who is primarily responsible for the accident pays the damages, even though this is not always the case. Florida is a no-fault state. This means you would be covered by your own insurance company for all or a part of your medical bills and lost wages if you were to get into a car accident, regardless of who was at fault. In a no-fault state, the law is applied differently. Depending on the state, insurance companies may be limited to the amount of damages they will pay. Pain and suffering claims in no-fault states are usually not allowed unless a person’s medical damages reach a certain level or they suffer a serious injury.

In a no-fault state like Florida, your medical expenses and lost wages should be dealt with by your own insurance company. In any case, property damage claims are the responsibility of the company that insures the primary negligent party. When you live in a no-fault state, you are usually required to cooperate with your insurance company, which can include providing a recorded statement or being examined by a medical examiner to determine the nature of your injuries.

How to File a Car Accident Claim in Florida

Contact Your Insurance Provider

Report the accident to your agent or insurer as soon as possible. You will need to provide the following information:

- The covered vehicle involved in the accident

- The person who drove

- The location and time of the accident

- The nature of the accident and the extent of the damage

- Information about the other driver, including their name and insurance information

- Persons involved in the accident and witnesses’ names and contact information

Keep track of the claim number you receive, as well as the name and direct phone number of the person you speak with.

Fill Out a Police Report

A police report number will be requested by your insurance company. It is still possible to file a report at a police station even if a police report was not obtained at the scene.

Wait for the Insurance Adjuster

Your claim will be handled by an adjuster assigned by the insurance company. You will probably be contacted by the adjuster for additional information. Keep your descriptions factual and do not speculate. Provide any photographs and contact information for any witnesses that you may have taken on the scene.

You should be aware that the conversation will be recorded and used to determine who is at fault. You may want to get in touch with an attorney before contacting the other driver’s insurance company if you are filing a personal injury claim.

An adjuster gathers information about the accident and inspects the damage to your car, or he will ask you to take the car to a shop that can perform the inspection.

Request a Report From the Insurance Adjuster

The adjuster will provide an initial estimate of the cost of repairs when they have considered the facts of the incident, including your insurance coverage and the vehicle’s damages. In determining how much your insurance company will pay for vehicle repair, they will consider this estimate or an estimate from a repair shop.

Factors that Impact the Value of a Car Accident Insurance Claim in Florida

When deciding what a personal injury claim is worth, insurance adjusters typically consider the same factors juries would. Some of these factors that determine the value of your claim are:

- The actual expenses incurred like medical bills as well as future expenses.

- A loss of income or the inability to earn a living

- “Pain and Suffering”

- Injury-related negative consequences suffered by the claimant.

In some cases, such as actual expenses and lost income, the damages can be determined fairly easily. On the other hand, losses like “pain and suffering” are subjective. In the realm of personal injury law, “pain and suffering” has no universal definition, but typically refers to:

- Experiencing physical pain as a result of the accident

- Physical discomfort resulting from receiving medical treatment, and

- Mental distress, sleeplessness, anxiety, and other psychological impacts of the accident and subsequent injuries.

A jury or an insurance company will usually evaluate the degree of pain and suffering you have endured based on your medical treatment and the injury you suffered. Another two factors that insurance adjusters take into account are the policy limits and the strength of the claim.

Car Insurance Policy Limits

There is no chance of an insurance company paying more than the policy’s maximum. As an example, if the at-fault driver carried $50,000 in liability insurance, the insurance company could only pay $50,000 for the accident. You’ll need to collect the difference from the at-fault party directly if your damages exceed their coverage limits.

The Strength of the Plaintiff’s Case

An insurer is more likely to offer a larger settlement if the plaintiff has a solid case (such as a medical malpractice claim where the physician left a surgical instrument inside the plaintiff) because a plaintiff’s win in court seems almost certain. Generally, the insurer will offer considerably less if the plaintiff’s claim is fairly weak since the claimant may end up in court and lose.

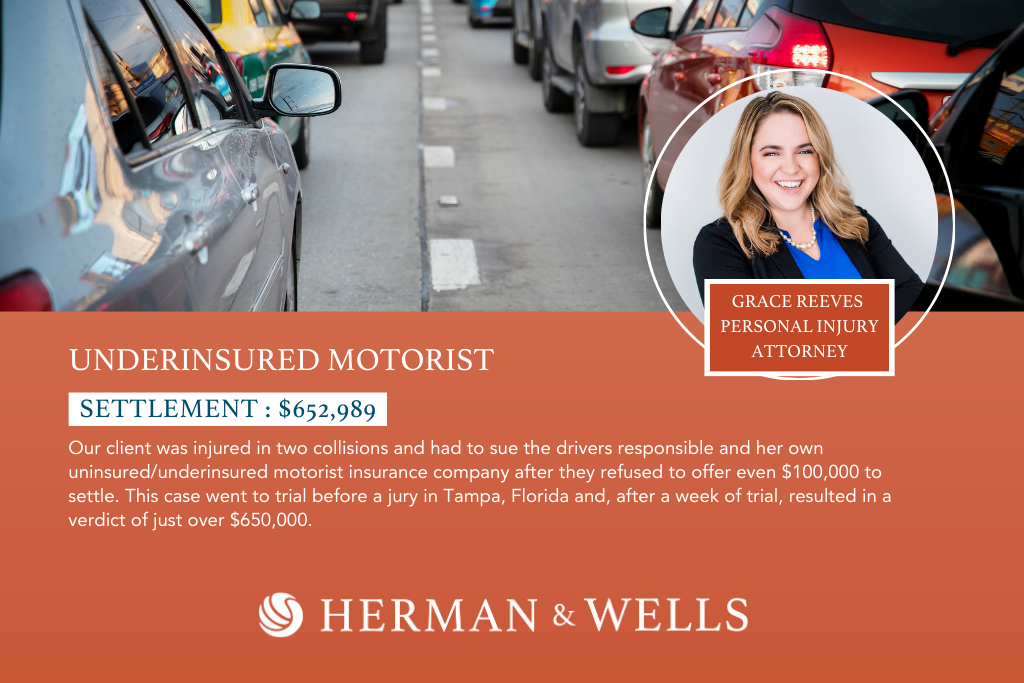

Florida Insurance Adjusters Have the Company’s Back, Not Yours

After a car accident claim is filed in Florida, an insurance adjuster (an employee of the company) is assigned to investigate what happened and determine the value of the claim. You must keep in mind that the insurer’s adjuster works for them. The adjuster’s primary goal is to keep any payout as low as possible so the insurance company can be more profitable.

Insurance adjusters want to avoid personal injury lawsuits as much as possible. The judge or jury will determine whether a case settles outside of court, and if it does, that case will go to trial, and they will decide who is at fault (“liable”), if compensatory damages should be paid, and if so, how much. Insurance companies face risk here because a jury can award very high damages if they are sympathetic to the plaintiff. Trial costs can also add up quickly for insurance companies – expenses that don’t help their bottom line. It is then the adjuster’s responsibility to get the claimant to accept the lowest settlement offer possible while avoiding litigation.

How to Respond to an Underpaid Insurance Claim in Florida

Pinellas accident victims are often offered significantly low settlements up front by insurance companies. Despite knowing that these sums are too small to cover the actual costs of an accident, they also recognize that accident victims are usually shaken up, and need to get their lives back to normal as soon as possible. As a result, the insurance company takes advantage of this mental state and offers a weak settlement in the hope that the victim will agree due to the sense of urgency.

You have the choice of accepting, countering their offer or suing.

Insurers frequently use this tactic, and negotiations often last for some time, with counter-offers being sent back and forth. However, this is a common insurance company tactic in response to a car accident claim, and negotiations often continue for some time, with counter-offers sent back and forth. Following a traumatic event like this, talking to a car accident lawyer is highly recommended, especially if there was extensive damage or injuries. In most cases, the first settlement offer is not enough to cover the actual expenses of an accident.

How to Respond to a Denied Insurance Claim in Florida

Your claim may be denied for a number of reasons. Perhaps you delayed filing your claim too long or failed to undergo an independent medical examination after the accident. Alternatively, your insurance policy may not cover the type of car accident you were involved in. If your claim is denied, you will receive notification from the insurance company. Once this happens, you will have the option to appeal the company’s decision. Companies can differ in their appeal procedures, so you should review the policy in question for information about next steps. In addition, you can file an insurance complaint with your state’s insurance department/agency, or you can sue the insurance company and the party they insured. It is probably in your best interest to consult with an insurance attorney if you have questions about the appeals process or if your appeal is denied.

Going to Trial after a Low Settlement Offer in Pinellas Park

If you file a lawsuit or threaten to file one, your insurance company usually responds — perhaps even with a fair settlement offer — but you might also be in for a long battle. Taking the step to file a lawsuit allows you to show the insurance company that you mean business, that you’re serious about your claim, and that you’re willing to fight for your legal rights. Simply filing a lawsuit can sometimes serve as a wake-up call for an adjuster, not to mention that it will kick off the costly and time-consuming litigation process, which insurers are generally trying to avoid.

However, if the insurance company does not consider your claim valid or if they believe they are on solid ground when it comes to their valuation, you could be in for a long battle. You’ll also have to deal with the time and costs of the litigation process (even though a lot of personal injury attorneys work on a contingency fee basis). Your attorney can help you come up with the best strategy for your car accident claim if you have one.

Call An Experienced Personal Injury Lawyer In Florida

If you’re worried that you won’t get the help you need to cover necessary medical treatment or to cover missed wages while recovering from an injury, then you should call a reputable personal injury lawyer in Florida. More specifically, you should contact Herman & Wells at (727) 821-3195. That way, you can be confident that you’ll actually get the opportunity to talk to a real trial attorney that has extensive knowledge about these insurance company tactics and how to respond to them.

Our law firm operates on a contingency fee, which is why we don’t charge for this initial consultation. You’ll get the opportunity to discuss your car accident with one of our personal injury attorneys and we can determine if you have a case we can help you with. If for some reason we aren’t going to be able to help you, we will still provide whatever guidance we can to help you in your situation.