Florida Hurricane Damage Lawyers

“It was a great pleasure having Cory Powell representing us after Hurricane Ian. This was an extremely emotional and physical hard time for us. Mr. Powell stepped up in every way possible to assure us we were in good hands. Many of our friends went on their own to file their insurance claims and know now they should of used a lawyer. I would highly recommend Mr. Powell and their firm for representation.”

Adan V

Contact us for a free case evaluation

By submitting my data I agree to be contacted

TABLE OF CONTENTS

- DO MOST HOMEOWNER’S POLICIES IN FLORIDA COVER HURRICANE DAMAGE?

- IS HURRICANE INSURANCE REQUIRED FOR FLORIDA HOMEOWNERS?

- WHAT IS & ISN’T COVERED BY HURRICANE INSURANCE IN FLORIDA?

- EXPERT TIPS FOR FILING A HURRICANE DAMAGE INSURANCE CLAIM

- WHAT FLORIDA HOMEOWNERS SHOULD KNOW ABOUT THE HURRICANE DAMAGE INSURANCE CLAIM PROCESS

- HOW TO DISPUTE A DENIED OR UNDERPAID HURRICANE DAMAGE INSURANCE CLAIM IN FLORIDA

- CONTACT OUR HURRICANE DAMAGE CLAIM LAWYERS

WHAT HAPPENED?

With hurricane season approaching, many Florida homeowners will need to file insurance claims for damage sustained to their property. However, insurance companies are often denying these claims, even when the damage is clearly consistent with a hurricane. If you have had your claim denied, don’t give up! A Florida hurricane damage lawyer can help you get the compensation you deserve.

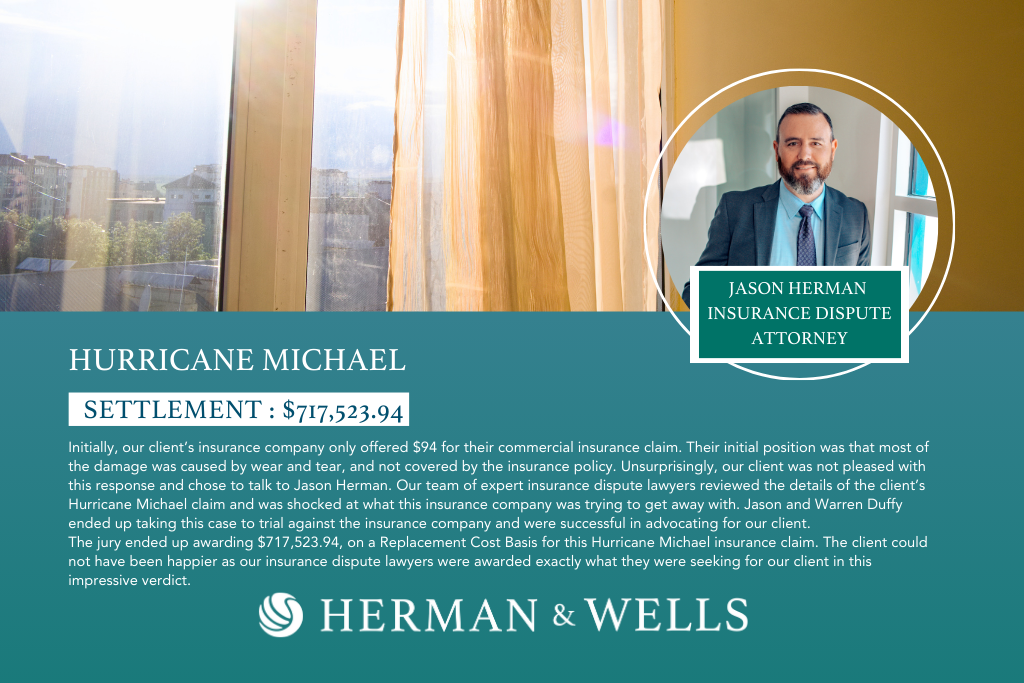

At Herman & Wells, we have years of experience dealing with insurance companies and know how to get them to pay up. Jason Herman had a tremendous victory in court earlier this year for a roof insurance claim that was previously underpaid. Our team of expert insurance dispute attorneys was shocked at what this insurance firm was attempting to get away with in the client’s Hurricane Michael claim. Jason and Warren Duffy ended up taking this case to trial against the insurance company and were successful in advocating for our client. The jury ended up awarding $717,523.94, on a Replacement Cost Basis for this Hurricane Michael insurance claim.

We understand what it takes to prove a hurricane damage claim and will work tirelessly on your behalf to ensure you receive the maximum amount of compensation possible. Contact us today for a free consultation to learn more about how we can help you.

Our law firm’s main offices are in Pinellas Park, but we have attorneys in St. Petersburg, Tampa, Seminole, Dunedin, Palm Harbor, Bradenton, and Sarasota.

THE CLIFF NOTES

Get the key takeaways from this page

THE CLIFF NOTES

Get the key takeaways from this page

- Hurricane insurance isn’t obligatory in Florida, but it’s crucial given the high hurricane risk; it’s often part of standard homeowners’ insurance, but homeowners should assess coverage and think about extra protection for risks like flooding.

- Hurricanes typically result in a range of property damage, including roof damage, water damage, wind damage, electrical damage, flood damage, and sewer damage.

- In Florida, standard homeowner’s insurance policies usually exclude coverage for hurricane damage, but supplemental options like hurricane wind coverage and flood insurance can fill the gap, while common exclusions encompass flood damage, tree/plant damage, wind damage, and damage from non-hurricane storms.

- Florida homeowners should document damage, provide proof of ownership for damaged items, and adhere to the four-year statute of limitations when filing insurance claims for hurricane damage.

- Insurance claims for hurricane damage may be denied due to reasons such as damage not caused by a hurricane, pre-existing damage, lack of coverage in the policy, late filing, insufficient documentation, or damage exceeding repair limits.

- If your hurricane damage claim is denied or underpaid, consider seeking assistance from Herman & Wells, experienced hurricane damage lawyers who can help you dispute the decision and secure the compensation you deserve.

DO MOST HOMEOWNER’S POLICIES IN FLORIDA COVER HURRICANE DAMAGE?

Most homeowner’s policies in Florida do cover hurricane damage, but there are specific details and conditions to consider. In Florida, hurricane insurance is typically included as part of a standard homeowners insurance policy, covering windstorm damage. This means damage caused by hurricane winds is generally covered under standard policies.

DO MOST HOMEOWNER’S POLICIES IN FLORIDA COVER HURRICANE DAMAGE?

Most homeowner’s policies in Florida do cover hurricane damage, but there are specific details and conditions to consider. In Florida, hurricane insurance is typically included as part of a standard homeowners insurance policy, covering windstorm damage. This means damage caused by hurricane winds is generally covered under standard policies.

Water damage, on the other hand, is treated differently. Standard policies usually do not cover flooding, which is more likely to be covered by separate flood insurance. They may cover water damage resulting from wind damage, like rain entering through a damaged roof.

It’s important to note that while wind damage is usually covered, most Florida homeowners’ insurance policies have a separate hurricane deductible, which is a percentage of the home’s insured value, rather than a flat dollar amount. This deductible applies only to damage caused by hurricanes and is triggered by specific conditions set by Florida law, such as when a hurricane watch or warning is issued.

In high-risk areas, particularly coastal regions, windstorm coverage might be excluded from regular homeowners policies, necessitating a separate windstorm policy. Additionally, flood damage, including that caused by hurricanes, is not covered under standard homeowners insurance and requires separate flood insurance, typically available through the National Flood Insurance Program (NFIP).

Therefore, while most homeowner’s policies in Florida do cover hurricane damage, particularly wind damage, homeowners should be aware of the specifics of their policies, including deductibles and exclusions, and consider additional coverage for flood damage.

IS HURRICANE INSURANCE REQUIRED FOR FLORIDA HOMEOWNERS?

Hurricane insurance is not legally required for homeowners in Florida. While the state is highly susceptible to hurricanes, Florida law does not mandate homeowners to have specific hurricane insurance. This is primarily because hurricane coverage is typically included within standard home insurance policies in Florida, rather than being sold as a separate policy.

Standard homeowners’ insurance policies in Florida generally cover hurricane damage under the windstorm or named storm deductible. This means that if a home is damaged by a hurricane, the homeowner would be responsible for paying the deductible amount before insurance coverage applies. However, there are exceptions, such as if the home is completely destroyed by a hurricane, in which case the insurance company may waive the deductible.

It’s important to note that while hurricane insurance is not mandatory, it is highly advisable for homeowners in Florida due to the high risk of hurricanes. Homeowners should be aware of what their insurance policy covers and consider additional coverage for exclusions like flooding, which is not typically covered under standard hurricane or homeowners’ insurance policies.

In summary, while not legally required, having hurricane insurance in Florida is crucial due to the high risk of hurricane damage, and it is usually included in standard homeowners’ insurance policies. Homeowners should carefully review their policies to understand the coverage and consider additional insurance for excluded risks like flooding.

COMMON TYPES OF PROPERTY DAMAGE CAUSED BY HURRICANES

When a hurricane hits, it can cause a lot of damage to homes and businesses. Many people are not aware of the different types of damage that can be caused by a hurricane. Some of the most common types of property damage include:

Roof Damage

The roof is one of the most important parts of a home, and it can be damaged very easily by a hurricane. If the roof is damaged, it can lead to water damage inside the home, and it can also lead to mold growth.

Water Damage

A hurricane can cause a lot of water to accumulate around the home, and this water can cause a lot of damage. Water can enter the home through the roof or windows, and it can also cause mold growth.

Wind Damage

A hurricane can cause a lot of wind damage to a home. The wind can blow off the roof or walls, and it can also overturn cars and trucks.

Electrical Damage

A hurricane can cause a lot of electrical damage to a home. The wind can knock down power lines, and it can also cause fires in the home.

Flood Damage

A hurricane can cause a lot of flooding in a home. The floodwater can damage the foundation of the home, and it can also cause mold growth.

Sewer Damage

A hurricane can wreak havoc on your sewage system, causing significant damage to pipes and waste systems. Everything from sinks to toilets to showers, as well as drinking water, might be impacted by sewer damage. Gutter damage might add up to expensive gutting costs.

If you have been affected by a hurricane, it is important to contact a Florida hurricane damage lawyer as soon as possible. A hurricane damage lawyer can help you recover damages for your property damage.

WHAT IS & ISN’T COVERED BY HURRICANE INSURANCE IN FLORIDA?

What Is Covered In Florida?

The topic of hurricane insurance is a complex one, but it is important to understand what is and is not covered by your policy. In Florida, standard homeowner’s insurance policies do not cover damage caused by a hurricane. However, there are several types of supplemental insurance policies available that can help protect you from such losses.

One common policy is called hurricane wind coverage. This policy covers damage to your home and its contents from wind-related damage caused by a hurricane. It does not cover flooding or other damage caused by the storm. Another option is flood insurance. This policy covers damage to your home and its contents from flooding, whether or not the flooding was caused by a hurricane.

If you are interested in purchasing supplemental hurricane insurance, it is important to shop around and compare policies. Be sure to read the fine print so you know exactly what is and is not covered. Also, be aware that policies usually have a waiting period before they go into effect, so don’t wait until the last minute to purchase coverage.

What Isn’t Covered In Florida?

Florida homeowners who suffer damage from a hurricane may find that their insurance policy does not cover all of their losses. There are a few things that are not typically covered by a hurricane damage insurance policy in Florida.

One such thing is damage caused by flooding. Most homeowner’s policies do not cover flood damage, which is why it is important to purchase a separate flood insurance policy if you live in a flood-prone area.

Another thing that is not typically covered by hurricane damage insurance is damage to trees or plants on the property. If your home sustains damage during a hurricane, and a tree falls on it, the damage to the home will likely be covered, but the damage to the tree will not be.

Wind damage is another thing that is often not covered by hurricane damage insurance policies. This includes damage to roofs, windows, and other parts of the home that are blown away by the wind. If you live in an area that is prone to high winds, be sure to ask your insurer about wind coverage.

Finally, damages caused by storms other than hurricanes are often not covered by Florida hurricane damage insurance policies. This includes thunderstorms, tornadoes, and even hail.

EXPERT TIPS FOR FILING A HURRICANE DAMAGE INSURANCE CLAIM

Making a hurricane damage insurance claim can seem daunting, but with the right preparation, it can be a relatively smooth process. Here are some tips from Florida property damage lawyers to help you through the process:

- Make sure you have all your documentation in order. This includes receipts for any repairs or replacements, as well as photographs or videos of the damage.

- Have a clear idea of what you are entitled to under your policy. This will help you negotiate with the insurance company and make sure you are getting the full value of your claim.

- Don’t be afraid to ask for help. If you need assistance in dealing with your insurance company, Florida hurricane damage lawyers can offer guidance and representation.

- Be patient and stay organized. It may take a while for your insurance company to investigate your claim and process your payment. Keep track of all communications with your insurer, and make copies of all documents related to your claim.

- Be prepared to negotiate. Insurance companies often try to pay less than the full amount of a claim. Be prepared to argue for the full value of your damages.

- Contact a lawyer if you need assistance filing your claim or negotiating with your insurance company. A qualified hurricane damage lawyer can help make sure you get the compensation you deserve for your hurricane damage.

WHAT FLORIDA HOMEOWNERS SHOULD KNOW ABOUT THE HURRICANE DAMAGE INSURANCE CLAIM PROCESS

Florida homeowners should be aware of their rights when making an insurance claim for hurricane damage. As with any insurance claim, there are a few things to keep in mind in order to make sure the process goes as smoothly as possible.

WHAT FLORIDA HOMEOWNERS SHOULD KNOW ABOUT THE HURRICANE DAMAGE INSURANCE CLAIM PROCESS

Florida homeowners should be aware of their rights when making an insurance claim for hurricane damage. As with any insurance claim, there are a few things to keep in mind in order to make sure the process goes as smoothly as possible.

First, always document the damage. Take pictures and videos of the damage to your property, as well as any belongings that were affected. This will help support your claim and ensure that you are compensated for the full extent of the damage.

Second, be prepared to provide proof of ownership for any damaged items. This can include receipts, bills of sale, or other documentation that proves you own the item in question.

Lastly, Florida homeowners should be aware that there is a statute of limitations for making hurricane damage insurance claims. In Florida, this is set at four years from the date of the storm. This means that homeowners have four years from the date of the storm to file a claim with their insurance company. If they wait longer than that, they may lose their chance to receive compensation for the damage.

It is important to note that this statute of limitations applies only to insurance claims. If you decide to pursue a lawsuit against the party responsible for your damage, you will have a different time limit in which to do so. Speak to a Florida hurricane damage lawyer about your specific case to learn more.

Common Reasons Hurricane Insurance Claims Are Denied

In the aftermath of a hurricane, many people file insurance claims to recoup some of their losses. However, not all of these claims are successful. There are a number of reasons why an insurance company might deny a hurricane insurance claim. Some of the most common reasons are:

- The damage was not caused by a hurricane. A common reason for denied hurricane damage claims is that the damage was not caused by a hurricane, or that the damage was not extensive enough.

- The damage was pre-existing. Many homeowners are not aware that their policy does not cover damage that was pre-existing.

- The policy does not cover hurricane damage. Some Florida homeowners’ insurance policies do not cover damage from hurricanes.

- The claim was filed too late. As mentioned earlier, If you file a claim after the statute of limitations, your insurance company might not cover the damage.

- The damage was not properly documented. The insurance company can determine that the damage done wasn’t from the hurricane but from something else. This can be a problem because if the damage is not documented properly, then the insurance company might not believe you and refuse to pay for the repairs.

- The amount of damage was too high. In some cases, some homes are so badly damaged that the insurance company deems them not worthy of repair.

HOW TO DISPUTE A DENIED OR UNDERPAID HURRICANE DAMAGE INSURANCE CLAIM IN FLORIDA

If you have a denied or underpaid hurricane damage claim, there are steps you can take to dispute the decision and get the compensation you deserve: The first step is to understand your policy. Read through it carefully and make sure you understand what is and isn’t covered. As mentioned earlier, many policies have specific provisions for hurricane damage. If your claim is denied or underpaid, review these provisions and make sure the insurance company is following them correctly. If you believe they are not, file a complaint with the Florida Department of Financial Services. They will investigate the insurance company’s actions and determine if they were in compliance with Florida law.

If you still aren’t getting the help you need, consider hiring a hurricane damage lawyer. A lawyer can help you navigate the complex legal process and ensure that your rights are protected. Disputing a denied or underpaid hurricane damage insurance claim can be tricky, but with the right guidance, you can get the compensation you deserve.

CONTACT OUR HURRICANE DAMAGE CLAIM LAWYERS

If your insurance company has denied or underpaid your hurricane damage claim, there are steps you can take to dispute the decision and get the compensation you deserve. Our team of experienced hurricane damage lawyers can help guide you through the process and ensure that you recover the full value of your claim. Contact us today for a free legal consultation, and let us help you get back on your feet after this devastating storm.

Please note: Our firm is only able to take on cases in Florida and Georgia. If you filed a claim in a different state, our attorneys unfortunately will not be able to take on your case.

CONTACT OUR HURRICANE DAMAGE CLAIM LAWYERS

If your insurance company has denied or underpaid your hurricane damage claim, there are steps you can take to dispute the decision and get the compensation you deserve. Our team of experienced hurricane damage lawyers can help guide you through the process and ensure that you recover the full value of your claim. Contact us today for a free legal consultation, and let us help you get back on your feet after this devastating storm.

Please note: Our firm is only able to take on cases in Florida and Georgia. If you filed a claim in a different state, our attorneys unfortunately will not be able to take on your case.

By submitting my data I agree to be contacted