Bradenton Hurricane Insurance Lawyers

“It was a great pleasure having Cory Powell representing us after Hurricane Ian. This was an extremely emotional and physical hard time for us. Mr. Powell stepped up in every way possible to assure us we were in good hands. Many of our friends went on their own to file their insurance claims and know now they should of used a lawyer. I would highly recommend Mr. Powell and their firm for representation.”

Adan V

Contact us for a free case evaluation

By submitting my data I agree to be contacted

TABLE OF CONTENTS

- DID YOUR INSURANCE COMPANY MAKE A BAD DECISION REGARDING YOUR HURRICANE DAMAGE CLAIM?

- DO YOU NEED TO HIRE A HURRICANE INSURANCE LAWYER?

- IS HURRICANE DAMAGE COVERED UNDER YOUR STANDARD HOMEOWNERS POLICY IN BRADENTON?

- HOW CAN OUR BRADENTON HURRICANE INSURANCE LAWYERS HELP YOU?

- COMMON REASONS HURRICANE DAMAGE CLAIMS ARE DENIED IN BRADENTON

- WHAT KIND OF HOME DAMAGE DO HURRICANES TYPICALLY CAUSE

- HOW DO INSURANCE COMPANIES RESPOND AFTER A HURRICANE HAS CAUSED MAJOR DAMAGE?

- HOW TO TELL IF YOUR INSURANCE AGENT ACTED NEGLIGENTLY

- CAN YOU SUE YOUR INSURANCE COMPANY FOR DENYING A HURRICANE DAMAGE CLAIM?

- WHAT IS OUR LAW FIRM’S PROCESS FOR INSURANCE DISPUTE CASES

- CONTACT OUR BRADENTON HURRICANE INSURANCE LAWYERS

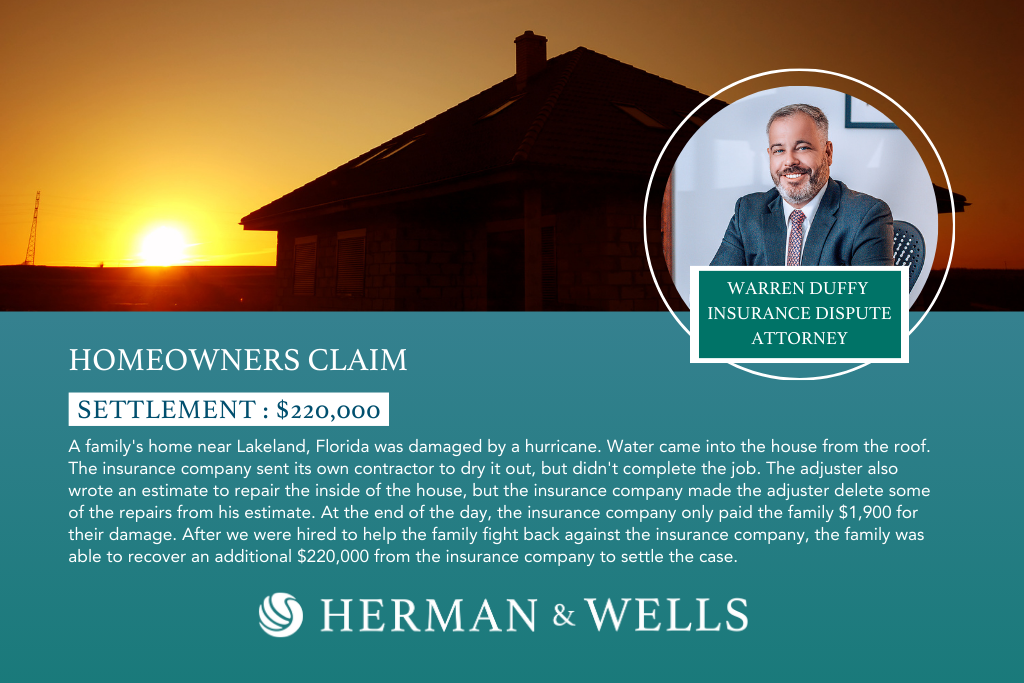

WHAT HAPPENED?

Should you request a free claim review with one of our Bradenton hurricane insurance lawyers? If your property damage claim has been underpaid or denied, we may be able to help.

At Herman & Wells, we specialize in helping Bradenton homeowners get the compensation they deserve after a devastating hurricane. We have years of experience dealing with insurance companies, and we know exactly how to keep them accountable to policyholders like you.

Call (727) 821-3195 if you’d like to schedule a free claim review with one of our Bradenton hurricane insurance lawyers. This is an opportunity to get a second opinion regarding your storm damage claim. You won’t regret taking this opportunity to talk with one of the highly experienced attorneys at Herman & Wells.

THE CLIFF NOTES

Get the key takeaways from this page

THE CLIFF NOTES

Get the key takeaways from this page

- In Bradenton, standard homeowner’s insurance usually doesn’t cover hurricane-related flood damage, prompting the need for separate flood insurance; while most renter’s insurance policies cover wind damage, comprehensive coverage may require additional hurricane insurance.

- Insurance companies commonly deny hurricane damage claims due to insufficient coverage, incorrect policy type, lack of coverage for the specific damage, failure to meet the hurricane deductible, or disputes over the cause of the damage.

- Hurricane damage to homes typically includes wind damage, flooding, and wind-blown debris, varying in severity based on the storm’s intensity and home construction.

- Promptly file an insurance claim after hurricane damage, but beware of insurance companies potentially denying claims or offering inadequate settlements and consult a hurricane insurance claim dispute lawyer to ensure fair compensation and assess any negligence by your insurance agent.

- Herman & Wells offers expert assistance for hurricane insurance disputes in Bradenton, providing free claim reviews and legal representation to ensure fair compensation—call (727) 821-3195 for help today.

DID YOUR INSURANCE COMPANY MAKE A BAD DECISION REGARDING YOUR HURRICANE DAMAGE CLAIM?

The hurricane lawyers of Herman & Wells can help. We have represented many clients in the Bradenton area who have been denied coverage or paid less than they deserved for their hurricane damage claims. We understand the insurance claims process and how to maximize your recovery. We will review your policy and Hurricane damage claim at no charge to determine if you have a case.

If you have hurricane damage and need help with your insurance claim, call the hurricane lawyers of Herman & Wells today for a free consultation.

DO YOU NEED TO HIRE A HURRICANE INSURANCE LAWYER?

If you’re a Bradenton resident, then you know that hurricane season is a time of year when it’s important to be prepared. Hurricane insurance can help give you peace of mind in the event that your home is damaged or destroyed by a storm.

However, hurricane insurance claims can often be complex and difficult to navigate on your own. That’s where hiring a hurricane insurance lawyer can be beneficial. A hurricane insurance lawyer can help you understand your policy and make sure that you get compensation for damages.

If you’ve been affected by a hurricane and need to file an insurance claim, contact Herman & Wells today. Our experienced Bradenton hurricane insurance lawyers can help you through every step of the claims process.

IS HURRICANE DAMAGE COVERED UNDER YOUR STANDARD HOMEOWNERS POLICY IN BRADENTON?

If your home sustains damage from a hurricane, you may be wondering if your standard homeowner’s insurance policy will cover the cost of repairs. The answer to this question is, unfortunately, it depends. Most standard homeowners insurance policies in Bradenton do not cover damage caused by floods. Hurricane damage is typically considered to be flood damage since the heavy rains associated with hurricanes can cause flooding.

Some insurers will sell you a separate flood insurance policy to cover hurricane-related damage, but this isn’t always the case. And even if your insurer does offer flood insurance, it may not cover the entire cost of repairing hurricane damage to your home. This is why it’s so important to review your homeowner’s insurance policy carefully before a hurricane hits. You need to know exactly what is and is not covered so that you can make an informed decision about whether or not to purchase additional insurance.

If you have questions about your homeowner’s insurance policy or need help filing a claim, the experienced Hurricane Insurance Lawyers of Herman & Wells can help. We have extensive experience handling hurricane insurance claims and can help you get the full amount of compensation you’re entitled to.

Does Renters Insurance Cover Hurricane Damage?

If you’re a renter in Bradenton, you may be wondering if your renter’s insurance will cover any hurricane damage. Most standard renters insurance policies will cover wind damage, but there are usually limits on how much coverage is available. For example, a typical policy might limit wind damage coverage to $500.

If you want more comprehensive coverage, you may need to purchase a hurricane insurance policy. Hurricane insurance policies are available through many different insurers, and they can cover wind damage as well as other types of hurricane-related damage, such as flooding.

If you’re not sure whether your renter’s insurance policy covers hurricane damage, or if you’re interested in purchasing a hurricane insurance policy, contact the Bradenton hurricane insurance lawyers of Herman & Wells for more information. We can help you understand your coverage options and make sure you have the protection you need.

HOW CAN OUR BRADENTON HURRICANE INSURANCE LAWYERS HELP YOU?

The hurricane season in Florida runs from June 1st to November 30th. During this time, homeowners in the state are at risk of damage to their property from high winds and flooding. If your home has been damaged by a hurricane, you may be entitled to compensation from your insurance company. However, as stated earlier, insurance companies are often reluctant to pay out on claims, and they may try to lowball you on the amount of money you are owed.

Our Bradenton hurricane insurance lawyers can help you navigate the claims process and fight for the full amount of compensation you are entitled to. We have extensive experience handling hurricane insurance claims, and we know how to build a strong case on your behalf.

COMMON REASONS HURRICANE DAMAGE CLAIMS ARE DENIED IN BRADENTON

After a hurricane, it’s not uncommon for insurance companies to deny claims. In fact, some insurance companies may even go as far as to cancel policies after a hurricane has caused damage. If your hurricane insurance claim has been denied, you may be wondering why. Here are some of the most common reasons hurricane damage claims are denied:

- The policyholder didn’t purchase enough insurance to cover the damages.

- The policyholder didn’t purchase the right type of insurance to cover the damages.

- The hurricane damage isn’t covered by the policy.

- The policy has a hurricane deductible that the policyholder didn’t meet.

- The insurance company says the damage wasn’t caused by the hurricane.

If your hurricane insurance claim has been denied, you may be able to appeal the decision. An experienced hurricane insurance lawyer can help you navigate the appeals process and get the compensation you deserve.

WHAT KIND OF HOME DAMAGE DO HURRICANES TYPICALLY CAUSE

Hurricane damage to homes can come in many different forms, depending on the intensity of the storm and the type of construction of the home. Some of the most common types of hurricane damage include:

- Wind damage: This can range from large branches falling on your roof to your entire roof being ripped off.

- Flooding: This can come from storm surges, heavy rains, or both.

- Wind-blown debris: Debris from other homes or buildings that have been picked up by hurricane-force winds can cause significant damage to your property.

If your home has sustained any of these damages, it is important to contact a hurricane insurance lawyer as soon as possible to help you navigate the insurance claims process.

HOW DO INSURANCE COMPANIES RESPOND AFTER A HURRICANE HAS CAUSED MAJOR DAMAGE?

If your home sustains damage from a hurricane, it is important to file a claim with your insurance company as soon as possible. The insurance company will then send an adjuster to assess the damage and determine how much they will pay for repairs.

HOW DO INSURANCE COMPANIES RESPOND AFTER A HURRICANE HAS CAUSED MAJOR DAMAGE?

If your home sustains damage from a hurricane, it is important to file a claim with your insurance company as soon as possible. The insurance company will then send an adjuster to assess the damage and determine how much they will pay for repairs.

After a hurricane has caused major damage, insurance companies often take one of two approaches:

- They may try to deny as many claims as possible in order to save money.

- They may try to lowball the policyholders who do have valid claims in order to settle for less than what the claim is actually worth.

Both of these approaches can be very frustrating for hurricane victims who are already dealing with the stress of storm damage. An experienced hurricane insurance lawyer can help you deal with the insurance company so that you can focus on rebuilding your home.

HOW TO TELL IF YOUR INSURANCE AGENT ACTED NEGLIGENTLY

What if your insurance company denies your claim? Or only offers you a fraction of what you need? You might be wondering if your insurance agent acted negligently. There are a few things you can look for to see if your insurance agent may have been negligent:

- Did your agent fail to inform you of all the coverages available to you?

- Did your agent tell you that you didn’t need certain coverages?

- Did your agent pressure you into buying a policy with less coverage than you wanted?

- Did your agent fail to explain the terms of your policy in a way that you could understand?

- Did your agent fail to send your premium payments to the insurance company in a timely manner?

- Did your agent fail to renew your policy on time?

- Did your agent fail to inform you of all the coverages available to you?

- Did your agent tell you that you didn’t need certain coverages?

- Did your agent pressure you into buying a policy with less coverage than you wanted?

- Did your agent fail to explain the terms of your policy in a way that you could understand?

- Did your agent fail to send your premium payments to the insurance company in a timely manner?

- Did your agent fail to renew your policy on time?

If you answered yes to any of these questions, then you may have a case against your insurance agent for negligence. You should speak to a hurricane insurance lawyer in Bradenton, Florida to learn about your legal options.

CAN YOU SUE YOUR INSURANCE COMPANY FOR DENYING A HURRICANE DAMAGE CLAIM?

If your hurricane damage claim was denied, you might be wondering if you have any legal recourse. The answer depends on the specifics of your case, but in general, you may be able to sue your insurance company if they acted in bad faith or breached the terms of your policy.

Bad faith insurance claims are when an insurance company denies a claim that should be covered or delays payment of a claim without a good reason. If your insurance company has acted in bad faith, you may be able to sue them and recover damages.

WHAT IS OUR LAW FIRM’S PROCESS FOR INSURANCE DISPUTE CASES

At Herman & Wells, we understand that hurricane season can be a stressful time for Bradenton residents. Not only are you dealing with the possible damage to your home or business, but you also have to contend with the hassle of filing an insurance claim. And in far too many cases, insurance companies will do everything they can to delay or deny valid claims.

That’s where our hurricane insurance dispute lawyers come in. We have over 20 years of experience handling hurricane insurance claims, and we know how to get results. We offer a free claim review to help you understand your legal options, and we don’t charge a fee unless we win your case. So if you’re dealing with an insurance dispute, please give us a call today. We’re here to help.

CONTACT OUR BRADENTON HURRICANE INSURANCE LAWYERS

Herman & Wells is a law firm that represents policyholders who have been denied hurricane insurance claims. We understand the challenges you’re facing and we’re here to help. Call us today for a free consultation.

We’ll review your case and advise you of your legal. Call us now at (727) 821-3195 to get started.

CONTACT OUR BRADENTON HURRICANE INSURANCE LAWYERS

Herman & Wells is a law firm that represents policyholders who have been denied hurricane insurance claims. We understand the challenges you’re facing and we’re here to help. Call us today for a free consultation.

We’ll review your case and advise you of your legal. Call us now at (727) 821-3195 to get started.

By submitting my data I agree to be contacted