Bradenton Insurance Claim Lawyers

“What a great firm, these guys did all the work. I used them on a insurance claim and they got everything I was asking for and more. They are not scared to get at it with these no paying insurance companies. If you’re like me, you pay a lot for home insurance and expect to be compensated when mother nature strikes. Herman and Wells got me what was right.”

Todd J

Contact us for a free case evaluation

By submitting my data I agree to be contacted

TABLE OF CONTENTS

- DO YOU NEED AN ATTORNEY TO DISPUTE YOUR INSURANCE COMPANY’S DECISION?

- WHEN DO YOU NEED AN INSURANCE DISPUTE LAWYER?

- WHAT TYPES OF CLAIMS CAN OUR BRADENTON INSURANCE DISPUTE LAWYERS HELP WITH?

- COMMON REASONS INSURANCE CLAIMS ARE DENIED IN BRADENTON

- DO YOU HAVE A BAD FAITH INSURANCE CLAIM IN BRADENTON?

- HOW TO TELL IF YOUR INSURANCE AGENT ACTED NEGLIGENTLY

- WHEN CAN YOU SUE AN INSURANCE COMPANY FOR DENYING A CLAIM?

- HOW CAN OUR BRADENTON INSURANCE CLAIM LAWYERS HELP YOU?

- WHAT IS OUR LAW FIRM’S PROCESS FOR INSURANCE DISPUTE CASES IN BRADENTON

- CONTACT OUR BRADENTON INSURANCE CLAIM LAWYERS

WHAT HAPPENED?

If you’re in Bradenton, Florida, and need a competent insurance claim lawyer, you’ve come to the right firm! Herman & Wells has a team of experienced lawyers who can help you get the compensation you deserve.

Whether you’ve been in an accident or your property has been damaged, we can help you navigate the complex world of insurance claims. We understand the law and know how to get you the best possible outcome.

Contact us today to schedule a free consultation. We’ll help you understand your rights and options, and we’ll fight for you every step of the way.

THE CLIFF NOTES

Get the key takeaways from this page

THE CLIFF NOTES

Get the key takeaways from this page

- Experienced Legal Support: Our law firm specializes in assisting Bradenton policyholders with wrongfully denied, delayed or underpaid insurance claims.

- Expertise in Various Claims: We handle a wide range of insurance claims, including property damage, commercial insurance, and life insurance claims.

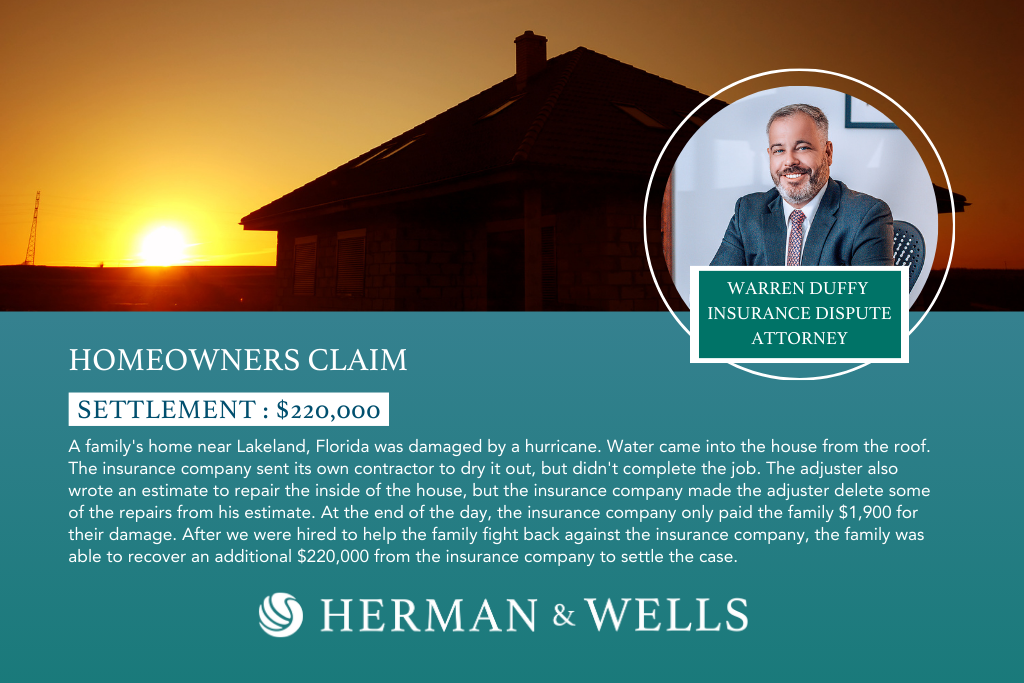

- Successful Case Examples: Our insurance claim lawyers have a track record of successful outcomes, such as recovering an additional $220,000 for a hurricane damage claim which the insurance company initially only paid $1,900.00 for.

- Bad Faith Insurance Claims: Our firm can help determine if your claim was handled in bad faith, such as denying your claim, delaying payment, or lowballing your settlement.

- Negligent Insurance Agents: Our attorneys will assess if an insurance agent acted negligently, like failing to disclose important policy details or giving poor advice.

- Suing Insurance Companies: We will guide when and how to sue an insurance company for denying a claim.

- Client-Centric Approach: Our lawyers work on a contingency basis and guide clients through the entire claim process, including litigation if necessary.

- Free Claim Review: Policyholders can contact Herman & Wells to book a free claim review with one of our experienced Bradenton insurance claim lawyers.

DO YOU NEED AN ATTORNEY TO DISPUTE YOUR INSURANCE COMPANY’S DECISION?

When you make an insurance claim, you expect your insurance company to cover the damages that you have incurred. Unfortunately, insurance companies are businesses motivated by profit, not compassion. As a result, they may try to low-ball you on your claim or deny it altogether. If you find yourself in this situation, you may need to hire an insurance claim lawyer to help you get the compensation you deserve.

The insurance claim lawyers at Herman & Wells have extensive experience helping people in Bradenton, Florida get the compensation they are entitled to. We will fight tirelessly to make sure that you are fairly compensated for your damages.

WHEN DO YOU NEED AN INSURANCE DISPUTE LAWYER?

If you’re having issues with your insurance company, you may need to hire an insurance dispute lawyer. Common reasons to hire an attorney include:

- Your insurance company is refusing to pay your claim

- Your insurance company is only offering a partial payment on your claim

- Your insurance company says your damage is not covered

- You have been denied insurance benefits

- Your insurance company is delaying your claim payment

An experienced insurance dispute lawyer will be able to help you navigate the often complex world of insurance claims and get you the money you’re entitled to. If you’re in Bradenton, FL, contact Herman & Wells today for a free consultation.

WHAT TYPES OF CLAIMS CAN OUR BRADENTON INSURANCE DISPUTE LAWYERS HELP WITH?

Wrongfully Denied, Underpaid Or Closed Legitimate Claims

Our Bradenton insurance claim lawyers have a lot of experience helping clients with insurance disputes. Insurance companies are difficult to deal with, but we can help you get compensation if your claim has been wrongfully denied, underpaid or closed. Don’t hesitate to contact us!

Property Damage

If your Bradenton, Florida home or business has been damaged due to the negligence of another, you may be able to file a property damage claim. The insurance claim lawyers at our Bradenton law firm can help you through the property damage claim process.

Commercial Insurance

Businesses in Bradenton, Florida purchase insurance to protect themselves from a variety of potential risks. When an insured event does occur, businesses expect their insurer to provide the coverage they paid for. Unfortunately, insurance companies are not always willing to pay out on valid claims. If your insurance company is denying your claim or offering a low settlement, you need experienced commercial insurance claim lawyers on your side.

The insurance claim attorneys at our Bradenton, Florida law firm have extensive experience handling all types of commercial insurance claims, including:

- Property damage claims

- Business interruption claims

- Inland marine claims

Life Insurance Claims

Life insurance claims can be tricky to navigate. If you are in Bradenton, Florida and feel like you have been wrongfully denied a life insurance claim, the insurance claim lawyers at our firm can help. We understand the frustration and confusion that comes with being denied a life insurance claim, which is why we offer a free consultation to discuss your case.

Our insurance claim lawyers will review your policy and any documentation you have to determine if you have a case. If we believe you have a case, we will work with you to gather the evidence needed to support your claim.

COMMON REASONS INSURANCE CLAIMS ARE DENIED IN BRADENTON

One of the main reasons that insurance claims are denied in Bradenton is because the insurance company believes that the policyholder is at fault. In order to prove that you are not at fault, you will need to hire an experienced Bradenton insurance claim lawyer.

COMMON REASONS INSURANCE CLAIMS ARE DENIED IN BRADENTON

One of the main reasons that insurance claims are denied in Bradenton is because the insurance company believes that the policyholder is at fault. In order to prove that you are not at fault, you will need to hire an experienced Bradenton insurance claim lawyer.

Another common reason for denied claims is that the insurance company believes that the damage is not covered by the policy. If you have a comprehensive policy, then you should be covered for most types of damage. However, if you have a limited policy, then you may only be covered for certain types of damage.

If your insurance claim has been denied, then you should contact an experienced Bradenton insurance claim lawyer as soon as possible. A Bradenton insurance claim lawyer will review your policy and help you understand why your claim was denied. The lawyer will also help you gather the evidence you need to prove your case and get the insurance benefits you deserve.

Do Insurance Companies Underpay Claims For Similar Reasons?

If your insurance claim has been denied or underpaid, you are not alone. Insurance companies routinely deny or lowball claims, hoping that policyholders will just give up and go away.

The Bradenton insurance claim lawyers of Herman & Wells have seen this happen time and time again. We believe that every person deserves to have their valid insurance claim honored, and we are here to help.

If your Bradenton, Florida insurance company has wrongfully denied or underpaid your claim, contact Herman & Wells today for a free consultation. We will review your case and help you understand your options for moving forward.

DO YOU HAVE A BAD FAITH INSURANCE CLAIM IN BRADENTON?

If you have a bad faith insurance claim in Bradenton, Florida, you may be feeling overwhelmed and uncertain about what to do next. The good news is that you don’t have to go through this process alone. An experienced Bradenton insurance claim lawyer can help you navigate the legal system and fight for the compensation you deserve.

Bad faith insurance claims can be complicated and frustrating. Insurance companies are in the business of making money, not paying out claims. They may try to deny your claim, delay payment, or lowball you on the settlement. This is where Bradenton’s insurance claim lawyer can help.

A Bradenton insurance claim lawyer will investigate your case and build a strong argument for why you are entitled to compensation. They will negotiate with the insurance company on your behalf and fight to get you the maximum possible settlement. If necessary, they will also take your case to court.

Don’t let the insurance company take advantage of you. If you have a bad faith insurance claim in Bradenton, Florida, contact an experienced Bradenton insurance claim lawyer today.

HOW TO TELL IF YOUR INSURANCE AGENT ACTED NEGLIGENTLY

Our Bradenton insurance claim lawyers handle all sorts of insurance disputes. One of the most common questions we get is how to tell if an insurance agent was negligent in handling a claim. Here are some things to look for:

- Did the agent fail to return your phone calls?

- Did the agent give you the run-around?

- Did the agent tell you that your claim was not covered when you thought it should be?

- Did the agent deny your claim without investigating it first?

WHEN CAN YOU SUE AN INSURANCE COMPANY FOR DENYING A CLAIM?

If you believe that your insurance company has wrongly denied your claim, you may be wondering if you can sue them. The answer to this question depends on a few factors, including the type of policy you have and the reason for the denial.

In general, you can only sue an insurance company if there is something in your policy that allows for it. For example, if your policy has a clause that allows for litigation in the event of a dispute, then you may be able to sue. However, if your policy does not have such a clause, you likely will not be able to sue successfully.

The other factor to consider is the reason for the denial. If the insurance company has a legitimate reason for denying your claim, such as you not meeting the requirements of your policy, then you likely will not be able to win a lawsuit. However, if the insurance company does not have a legitimate reason for denying your claim, you may have a better chance of success if you sue.

If you are thinking about suing your insurance company, you should speak to an experienced Bradenton insurance claim lawyer to learn more about your legal options.

HOW CAN OUR BRADENTON INSURANCE CLAIM LAWYERS HELP YOU?

If you’re in Bradenton, Florida, and you need help with an insurance claim, our Bradenton insurance claim lawyers can help. We’ve helped people with all kinds of insurance claims, from car insurance to health insurance. We know the ins and outs of the insurance system, and we can help you get the compensation you deserve.

WHAT IS OUR LAW FIRM’S PROCESS FOR INSURANCE DISPUTE CASES IN BRADENTON

Our Bradenton, Florida insurance claim lawyers have a process that is designed to get you the best possible outcome for your case. The first step is to gather all of the necessary documentation. This will include your policy, any correspondence with the insurance company, and any estimates for repairs or replacement of damaged property. Next, we will review your case and determine what the best course of action is. We will then contact the insurance company and attempt to negotiate a settlement. If we are unable to reach an agreement, we will file a lawsuit on your behalf.

What makes our firm different is that we always put our clients first. We understand that this is a difficult time for you, and we will do everything we can to help you get the best possible outcome for your claim. We are committed to providing personalized service and will stay in touch with you throughout the process.

CONTACT OUR BRADENTON INSURANCE CLAIM LAWYERS

If you believe your insurance company has treated you unjustly, you may be entitled to compensation. Florida’s insurance claim process can be complex and frustrating, but our Bradenton insurance claim lawyers can help.

We offer a free consultation so that we can review your case and determine how we can best assist you. Call Herman & Wells at (727) 821-3195 today to schedule your appointment. We look forward to speaking with you!

CONTACT OUR BRADENTON INSURANCE CLAIM LAWYERS

If you believe your insurance company has treated you unjustly, you may be entitled to compensation. Florida’s insurance claim process can be complex and frustrating, but our Bradenton insurance claim lawyers can help.

We offer a free consultation so that we can review your case and determine how we can best assist you. Call Herman & Wells at (727) 821-3195 today to schedule your appointment. We look forward to speaking with you!

By submitting my data I agree to be contacted