Seminole Insurance Claim Lawyers

“In the beginning it was rough with any suing lawyer. But once we got to know each other, it is a real team that will fight for you. They were patient and did a good job. Settled my case to 95% of my expectation. Will I use them again? Yes. Will I recommend them to friends? Yes. The lawyer that I worked with, his name is Warren, down to earth kind of a person – always took my call, or returned calls as promised.”

R H

Contact us for a free case evaluation

By submitting my data I agree to be contacted

TABLE OF CONTENTS

- WHEN SHOULD YOU HIRE AN ATTORNEY FOR AN INSURANCE CLAIM?

- WHAT TYPES OF CLAIMS CAN OUR SEMINOLE INSURANCE DISPUTE LAWYERS HELP WITH?

- COMMON REASONS INSURANCE CLAIMS ARE DENIED IN SEMINOLE

- IS A LAWYER REQUIRED TO DISPUTE YOUR INSURANCE COMPANY’S DECISION?

- WHEN CAN YOU SUE AN INSURANCE COMPANY FOR DENYING A CLAIM?

- HOW CAN OUR SEMINOLE INSURANCE CLAIM LAWYERS HELP YOU?

- WHAT IS OUR LAW FIRM’S PROCESS FOR INSURANCE DISPUTE CASES IN SEMINOLE

- OUR SEMINOLE INSURANCE CLAIM LAWYERS CAN HELP WITH THESE TYPES OF CLAIMS

- CONTACT OUR SEMINOLE INSURANCE DISPUTE LAWYERS

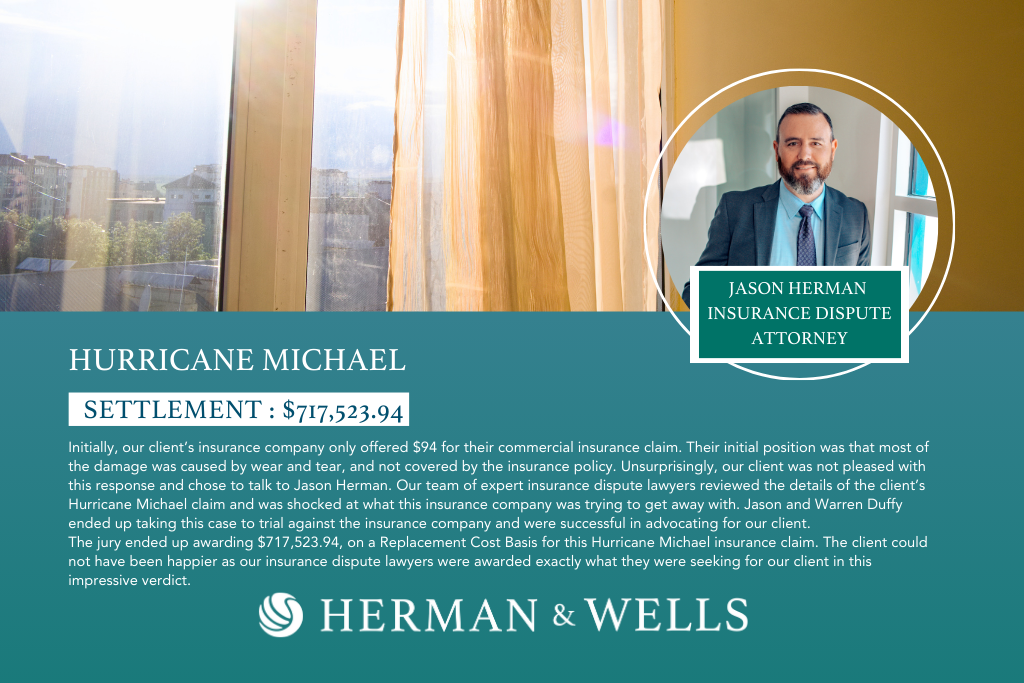

WHAT HAPPENED?

If you’re for experienced Seminole insurance claim lawyers, you’ve come to the right place. Our attorneys may be able to help you with the insurance claim issues you’re facing. Our firm is home to a diverse team of insurance dispute lawyers have years of experience dealing with these types of cases, so we know what it takes to get the results you deserve.

Contact us today at (727) 821-3195 for a free consultation to see how we can help you.

THE CLIFF NOTES

Get the key takeaways from this page

THE CLIFF NOTES

Get the key takeaways from this page

- Experienced Legal Support: Our law firm specializes in assisting Seminole policyholders with wrongfully denied or underpaid insurance claims.

- Expertise in Various Claims: We handle a wide range of insurance claims, including property damage, homeowners insurance, commercial insurance, and life insurance claims.

- Bad Faith Insurance Claims: Our firm can help determine if your claim was handled in bad faith, such as through inadequate investigation or delayed payment.

- Negligent Insurance Agents: Our attorneys will assess if an insurance agent acted negligently, like failing to disclose important policy details or giving poor advice.

- Suing Insurance Companies: We will guide when and how to sue an insurance company for denying a claim.

- Client-Centric Approach: Our lawyers work on a contingency basis and guide clients through the entire claim process, including litigation if necessary.

- Free Claim Review: Policyholders can contact Herman & Wells to book a free claim review with one of our experienced Seminole insurance claim lawyers.

WHEN SHOULD YOU HIRE AN ATTORNEY FOR AN INSURANCE CLAIM?

If you have ever had the unfortunate experience of filing an insurance claim, you know that it can be a long and frustrating process. You may also know that insurance companies are not always quick to pay out claims, sometimes waiting until the very last minute (or beyond!) to deny them. This is where an experienced Seminole insurance dispute lawyer can come in handy. A good lawyer will know how to negotiate with the insurance company on your behalf and will make sure that you get the money you deserve for your damages.

Some policyholders believe that hiring an attorney is their last option when dealing with an uncooperative insurance company, but there are several compelling reasons to seek assistance sooner rather than later:

- Our firm’s initial talk with people about their insurance issues is always free. If we end up taking on the case, we don’t charge unless we win money for our clients.

- Uncertainty is stressful, and an insurance lawyer can help explain in plain language what is really going on with your claim and what your options are.

- A lawyer with a long track record of success will have an excellent understanding of insurance companies’ legal obligations, and they’ll be able to spot when an insurance company violates its own policy or the law, or attempts to undervalue your claim.

- If your policy requires an appraisal, an experienced attorney can assist you in successfully completing the procedure.

- Attorneys may check your paperwork to ensure that you are carrying out all of the obligations imposed on you as a policyholder. If you don’t get this right, the insurance company can sometimes get out of paying your legitimate claim on a technicality.

- Attorneys can advise you when it comes to important timelines or if the statute of limitations impacts your insurance claim dispute.

It’s important to know that you don’t have to accept what the insurance company tells you in regard to your claim. Seminole insurance companies get things wrong all the time. If you have the slightest doubt about whether your claim is being handled the right way, an attorney with experience fighting insurance companies can help.

WHAT TYPES OF CLAIMS CAN OUR SEMINOLE INSURANCE DISPUTE LAWYERS HELP WITH?

Property Damage Claims

Many Seminole property owners have their property claims denied, delayed, or underpaid. If you’re having trouble convincing your insurance company to pay up for your damaged property, it’s time to call an insurance dispute lawyer. Our law firm has considerable expertise dealing with property insurance claims and flipping denied or underpaid claims into paid settlements.

Homeowners Insurance Claims

Homeowners with insurance claims can have very frustrating experiences with their insurance companies. Sometimes an insurance company will pay for damage at one home and deny exactly the same damage for a neighbor. Adjusters go silent on homeowners and money for repairs doesn’t come when it’s needed. The insurance dispute lawyers at our firm have represented Seminole homeowners against their insurance companies when claims were denied or short-paid, obtaining settlements that allowed those homeowners to put their houses back together.

Commercial Insurance Claims

Businesses insure their property and income against losses, and their insurance companies frequently drag out claims, deny them, or don’t pay enough to complete repairs. Our firm has represented businesses with losses from fires, collapses, storms, water, and more. If your business’s claim is not being handled correctly by your insurance company, our lawyers can talk about your company’s options.

Life Insurance Claims

Life insurance claims can be especially frustrating. The folks making the claim have just lost a family member and now are forced to jump through hoops by an insurance company, including gathering medical records and other documents. Our firm handles a variety of life insurance disputes. We see life insurance companies try to deny claims based on information stated in the insurance application. Life insurers will also sometimes try to pay the wrong beneficiary.

If you’re dealing with an insurance issue and want to talk about it with a lawyer, contact our insurance claim lawyers. We’ll go through your policy and explain your rights under it. We will pursue your claim aggressively if we feel you have a valid claim.

COMMON REASONS INSURANCE CLAIMS ARE DENIED IN SEMINOLE

There are several reasons why an insurance claim might be denied in Seminole, FL. Some of the most common reasons are:

Insurance Policy Exclusions

The insurance company believes that the damage was caused by something that the policy doesn’t cover. Insurance policies contain pages and pages of exclusions and limitations that lay out the things that the policy covers or doesn’t. Sometimes those exclusions and limitations are subject to multiple interpretations.

Dispute Over The Actual Cost Of Repair

The insurance company believes that the damages were not as extensive as claimed by the policyholder. This describes just about every underpaid claim out there. Insurance company adjusters will write estimates that are lower than the actual cost of repair or leave out necessary repairs.

Breach Of Policy Conditions

The policyholder did not follow the insurance company’s conditions properly. It’s critical to grasp your insurance policy’s conditions. If you engage in conduct that would jeopardize your coverage, your insurance company may not be required to compensate your claim.

Insurance Claim Was Filed Late

The policyholder filed a claim too late. Policies require customers to report their claims on a timely basis. Even though late reporting doesn’t automatically disqualify a claim, the initial claim decision might still be a denial if too much time has passed.

IS A LAWYER REQUIRED TO DISPUTE YOUR INSURANCE COMPANY’S DECISION?

Most insurance companies won’t change their minds unless you raise the stakes. That’s where a Seminole insurance dispute lawyer comes in. A lawyer who fights insurance companies can file a lawsuit, make formal demands through the State of Florida, put the insurance company on notice of bad faith, or threaten the insurance company with all of these if it refuses to settle the claim.

WHEN CAN YOU SUE AN INSURANCE COMPANY FOR DENYING A CLAIM?

When a policyholder sues an insurance company for denying a claim, the lawsuit is for “breach of contract.”

WHEN CAN YOU SUE AN INSURANCE COMPANY FOR DENYING A CLAIM?

When a policyholder sues an insurance company for denying a claim, the lawsuit is for “breach of contract.”

The contract is the policy. And breaching the policy means that the insurance company had an obligation that it didn’t meet. To sue your insurance company, you need to prove that the insurance company was supposed to pay for the claim and, instead, denied it.

There are sometimes other requirements that a policyholder needs to meet before filing a lawsuit. Before our firm files any lawsuit against an insurance company we check to make sure we have proof that the insurance company breached the policy, and we also check to make sure all the requirements have been met to allow the case to go forward.

HOW CAN OUR SEMINOLE INSURANCE CLAIM LAWYERS HELP YOU?

If you find yourself in the midst of an insurance dispute in Seminole, it’s important to have a team of experienced lawyers on your side. Our Seminole insurance claim lawyers are here to help you get the most out of your claim and get you back on track. We have a proven track record of success in helping clients achieve favorable outcomes, and we’re ready to put our experience to work for you. Contact us today for a free consultation to discuss your case.

WHAT IS OUR LAW FIRM’S PROCESS FOR INSURANCE DISPUTE CASES IN SEMINOLE

We understand how stressful it may be to deal with an insurance company when they deny or underpay your claim. From the first contact with a potential client, our goal is to try to help reduce that stress and provide the best options for moving forward.

How We Work With Our Clients

When someone calls us with an insurance issue, we talk to them about what happened and get some key information like:

- What caused the loss or damage?

- What repairs have been made and what are left to be made?

- Who is the insurance company?

- What was the claim decision (denied? underpaid? no decision at all?)?

- What’s the timeline on the claim (when did the loss happen, when was it reported, and what has the insurance company done since then)?

- If we think we can help get a better result, we’re hired on a contingency basis–meaning we get paid out of whatever we recover from the insurance company, not out of our client’s pocket.

We then will gather important documents and other evidence, hire any expert witnesses (like engineers and contractors) needed, and give the client our take on their case when we have all of the information, as well as our recommendations on whether and when to sue or settle.

If the case can’t be resolved without a lawsuit, we explain the litigation process to our client and, once everyone is on the same page, we file the lawsuit papers with the court. We have experience fighting insurance companies all the way through trial, but most cases settle during the course of a lawsuit short of a trial.

During the entire process, we make sure the client knows what’s going on and why, what to expect, and continue to give advice about the case.

OUR SEMINOLE INSURANCE CLAIM LAWYERS CAN HELP WITH THESE TYPES OF CLAIMS

The highly experienced insurance lawyers at Herman & Wells have successfully represented clients in a diverse variety of insurance disputes and denied claims. Seminole residents with a denied or underpaid insurance claim can call (727) 821-3195 for a free consultation and claim review with one of our attorneys.

After talking with an insurance claim lawyer, you’ll understand what your legal options are and if our team can help you. Our law firm’s initial consultation is offered free of charge because we work with our clients based on a contingency fee agreement (our firm doesn’t earn anything for our efforts unless we are successful in advocating for you).

Here are some of the types of insurance disputes and claims we can help Seminole residents with:

CONTACT OUR SEMINOLE INSURANCE DISPUTE LAWYERS

If you find yourself in a dispute with your insurance company, don’t hesitate to reach out for help. Our Seminole insurance claim lawyers know how to get the best results for their clients.

We offer free claim reviews so that you can get answers about your claim without any delay. Call (727) 821-3195 today to book an appointment and let us start fighting for you.

CONTACT OUR SEMINOLE INSURANCE DISPUTE LAWYERS

If you find yourself in a dispute with your insurance company, don’t hesitate to reach out for help. Our Seminole insurance claim lawyers know how to get the best results for their clients.

We offer free claim reviews so that you can get answers about your claim without any delay. Call (727) 821-3195 today to book an appointment and let us start fighting for you.

By submitting my data I agree to be contacted