Living in Florida comes with a certain amount of risk, and one of the biggest dangers is the threat of hurricanes. Every year, hurricane season brings the potential for devastating storms that can damage homes and businesses. It really doesn’t make sense for a Florida homeowner to not have hurricane insurance for their property. But what are the hurricane insurance requirements in the Sunshine State?

Even though the risk posed by these massive storms is high, Florida doesn’t have a mandatory hurricane insurance requirement. That is because hurricane insurance isn’t sold as a separate policy in Florida. This form of coverage is included as a part of a standard insurance policy.

The Cliff Notes: Key Takeaways From This Post

- 1Hurricane insurance typically covers wind damage, storm surge and damage from named storms.

- 2Hurricane insurance isn’t mandatory in Florida, it’s included in standard home insurance policies.

- 3Exclusions for standard policies include sewer/drain backup, flooding, wind damage, mold growth and personal belongings.

- 4Florida homeowners pay higher premiums compared to the national average ($2,084 vs $1,192 per year), but still reasonable compared to other hurricane-prone states.

- 5Discounts are available to help offset the cost of hurricane insurance such as installing wind-resistant features or enrolling in the Florida Property and Casualty Association discount program.

- 6Deductibles must be met before benefits are paid out – usually based on percentage of home’s insured value (e.g., 2% of $200,000 = $4,000 deductible).

- 7If dispute arises between homeowner and insurer over requirements for coverage or denied claims, contact an experienced hurricane attorney.

Hurricane Insurance Coverage Under Different Types Of Policies

Under a standard homeowner’s insurance policy in Florida, hurricane damage is typically covered under the windstorm or named storm deductible. This means that if your home sustains damage from a hurricane, you would be responsible for paying the deductible amount before your insurance coverage would kick in.

There are some exceptions to this rule, however. For example, if your home is completely destroyed by a hurricane, your insurance company may waive the deductible. Additionally, if you have a separate hurricane insurance policy, the deductible on that policy would apply instead of the windstorm or named storm deductible on your homeowner’s insurance policy.

If you have any questions about what is and isn’t covered under your homeowner’s insurance policy in the event of a hurricane, you should contact your insurance agent or company for more information.

What Does Hurricane Insurance Cover?

Hurricane insurance covers damage caused by hurricanes, tropical storms, and other named storms. It typically covers wind damage and storm surge. Hurricane insurance is separate from your regular homeowner’s insurance policy – it’s a rider that you must purchase separately.

Florida requires all homeowners to carry hurricane insurance if they live in a hurricane-prone area. This is because hurricane damage is not covered by standard homeowners insurance policies. If you live in Florida and don’t have hurricane insurance, you’re taking a big risk.

What Hurricane Insurance Doesn’t Typically Cover In Florida

While most people think that their hurricane insurance policy will cover any and all damage that a hurricane may cause to their home, this unfortunately is not always the case. In fact, there are several key things that your standard hurricane insurance policy is likely to exclude coverage for. It’s important to be aware of these exclusions so that you can plan and prepare accordingly. Some of the key things that hurricane insurance typically does not cover in Florida include:

- Sewer or drain backup: If your sewer or drains back up due to heavy rains, your hurricane insurance policy will likely not cover the damages. You may, however, be able to purchase additional coverage for this type of event.

- Flooding: Standard hurricane insurance policies also exclude coverage for flooding. This is one of the most common exclusions, so it’s important to be aware of it. If you live in an area that is prone to flooding, you may want to purchase additional flood insurance to protect your home.

- Wind damage: surprisingly, wind damage is also typically excluded from standard hurricane insurance policies. This means that if your home sustains damage from high winds, your policy may not cover the repairs.

- Mold: Mold growth is often a result of water damage, which is often excluded from hurricane insurance policies. As such, mold damage is also typically not covered by these policies.

- Personal belongings: Your hurricane insurance policy will likely only cover damage to the structure of your home, and not to your personal belongings. This means that if your furniture, electronics, or other personal belongings are damaged by a hurricane, you will likely have to pay to replace them yourself.

In short, it’s important to be aware of the limitations of your hurricane insurance policy before a storm hits. That way, you can be sure to have the coverage you need to protect your home and belongings.

How Much Do Florida Homeowners Pay For Hurricane Insurance Compared To Other States?

Florida homeowners are no strangers to hurricanes. In fact, Florida is the most hurricane-prone state in the continental U.S., according to the National Oceanic and Atmospheric Administration (NOAA). This means that Floridians are used to having hurricane insurance – it’s just a part of life here. But how much do Florida homeowners pay for hurricane insurance compared to other states?

According to the Insurance Information Institute (III), the average premium for hurricane insurance in Florida is $2,084 per year. This is higher than the national average of $1,192 per year. However, when you compare this to other hurricane-prone states, Florida’s rates are actually quite reasonable. For example, in Louisiana – the second most hurricane-prone state – the average premium for hurricane insurance is $3,075 per year. In Texas – the third most hurricane-prone state – the average premium is $2,451 per year.

So, while Florida homeowners do pay more for hurricane insurance than the average American, they are not paying exorbitant rates compared to other hurricane-prone states. Furthermore, Florida homeowners have access to a number of different discounts that can help offset the cost of hurricane insurance. For example, many insurers offer discounts for installing wind-resistant features on your homes, such as impact-resistant windows or hurricane shutters.

Additionally, the Florida Property and Casualty Association offers a discount program for policyholders who have hurricane-resistant features installed in their homes. To learn more about this program, visit their website or speak with your insurance agent.

In short, Florida homeowners should not be discouraged by the cost of hurricane insurance. Yes, it is more expensive than average, but it is still relatively affordable – especially when you compare it to other hurricane-prone states. And, there are a number of discounts available that can help offset the cost. If you have any questions about Florida’s hurricane insurance requirements or how to get the best rate on your policy, speak with a knowledgeable insurance agent today.

Hurricane Deductibles In Florida

If you do have hurricane insurance, it’s important to understand what your policy covers. Most policies have deductibles that must be met before the insurer will pay out any benefits. For example, your hurricane insurance policy might have a 2% hurricane deductible. This means that you would be responsible for the first 2% of damages caused by a hurricane. Hurricane deductibles are usually based on a percentage of your home’s insured value, rather than a flat dollar amount. So, if your home is insured for $200,000 and you have a 2% hurricane deductible, your hurricane deductible would be $4,000.

Here’s a short video that could help explain hurricane insurance deductibles:

Some insurers offer hurricane deductibles that are lower than 2%. For example, you might be able to find a policy with a 1% hurricane deductible or even a 0.5% hurricane deductible. If you live in an area that is prone to hurricanes, it’s important to make sure that you have adequate hurricane insurance coverage. Otherwise, you could be left with a huge repair bill if your home is damaged by a hurricane.

Best Providers For Hurricane Insurance In Florida

Finding the right hurricane insurance for your home in Florida is important. As a homeowner in Florida, you know that hurricanes are a genuine threat. That’s why it’s so important to have hurricane insurance in place before the storm season begins. But with so many different providers and policies to choose from, it can be difficult to know where to start. Here are some of the best hurricane insurance providers in Florida:

- State Farm is one of the largest and most well-known insurance companies in the country. They offer a variety of different homeowners insurance policies, including hurricane coverage.

- Allstate is another large insurance company that offers hurricane insurance for Florida homeowners.

- USAA is a well-respected insurance company that specializes in serving military members and their families. They offer a variety of different insurance policies, including hurricane coverage.

- Chubb is a leading provider of insurance for high-end homes and properties. They offer hurricane insurance for Florida homeowners.

- Travelers is a large insurance company that offers a variety of different insurance policies, including hurricane coverage.

When shopping for hurricane insurance, it’s important to compare different providers and policies to find the best coverage for your needs. Make sure to read the fine print and understand exactly what is and isn’t covered by your policy. As mentioned earlier, Florida has specific hurricane insurance requirements that all homeowners should be aware of. If you have any questions about your policy or coverage, contact your insurance provider or agent.

Will Disputing A Denied Hurricane Claim Impact Your Rates?

If your hurricane insurance claim is denied, you have the right to appeal. However, some people wonder if going through this appeals process will impact their future rates. The answer is that it depends on the insurance company. Some companies will raise rates after an appeal, while others will not. It is important to contact your insurance company and ask about their policy on rate increases after an appeal before you begin the process. If you do decide to go through with the appeals process, there are a few things you should keep in mind. First, you will need to gather all the evidence you can to support your case. This includes things like receipts, photos, and any other documentation you have.

Next, you will need to write a letter to the insurance company outlining your case and why you believe they should pay for the damages. It is important to be polite and professional in this letter. You may also want to include a list of the evidence you have collected. Once you have sent in your appeal, the insurance company has 30 days to respond. If they deny your appeal again, you can file a complaint with the Florida Department of Financial Services.

Going through the appeals process can be time-consuming and frustrating. However, it is important to remember that you have a right to do this if you feel like your hurricane insurance claim was unfairly denied. If you have any questions about the process, you should contact an experienced hurricane insurance attorney who can help guide you through it.

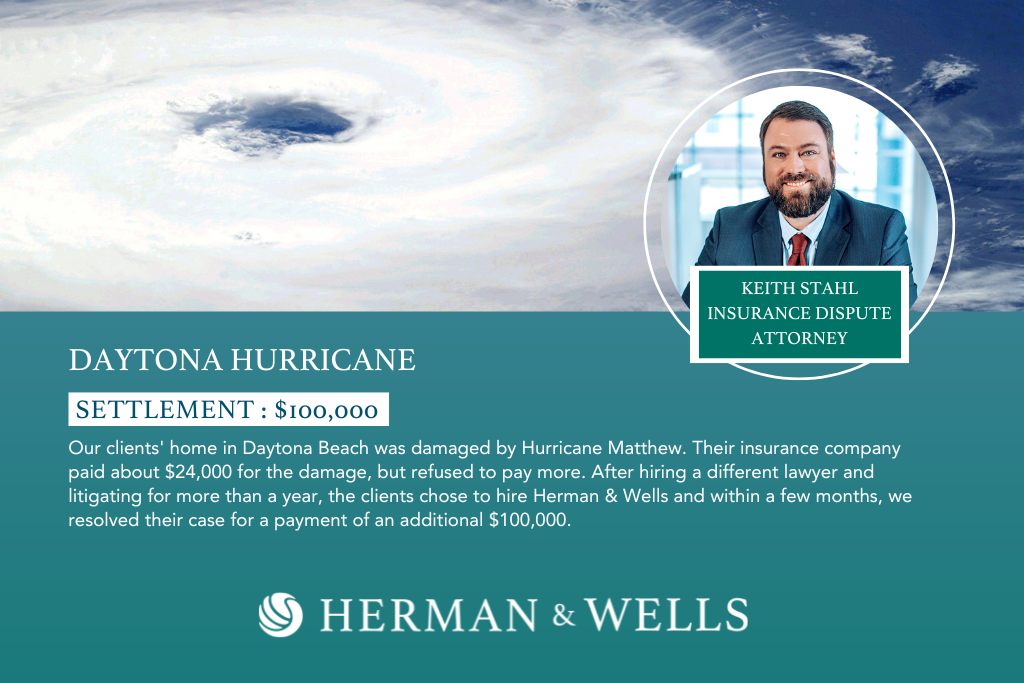

Need A Hurricane Insurance Lawyer In Florida?

If you’re a Florida homeowner, you know that hurricane insurance is a must. But what you may not know is that Florida has specific requirements for hurricane insurance coverage. And if your insurer doesn’t meet those requirements, you could be left high and dry when it comes to making a claim for hurricane damage.

Need a Hurricane Insurance Lawyer in Florida? We Can Help. The experienced hurricane insurance lawyers at Herman & Wells can help you understand your policy and make sure it meets Florida’s requirements. And if you need to file a claim, we can help you navigate the process and get the compensation you deserve. Call (727) 821-3195 today for a free consultation.