As a Florida business owner, you can safeguard yourself from any prospective financial losses by obtaining commercial property insurance. This coverage includes theft, vandalism, mold damage, water damage and other natural occurrences. You can find numerous safeguards against the following natural disasters:

- hurricanes and tornadoes

- windstorms

- lightning

- fires

- floods

In the event of a loss to your business, your commercial property insurance may be able to compensate you. You may find yourself dealing with commercial insurance claim dispute. Whether it be related to a damaged property or out-of-pocket costs following an injury claim on your premises – managing these issues can be physically and financially draining. At best, they can cause delays in operations while you seek resolution; at worst, they could lead to costly litigation if left unresolved.

The Cliff Notes: Key Takeaways From This Post

- 1Florida has a statute of limitations for filing commercial insurance claims of 4 years from the date of the incident. When filing a claim you must provide necessary information including details of incident and medical records pertaining to any injuries.

- 2Florida insurance companies have an obligation to act in good faith during investigation process which should include gathering evidence, interviewing parties and obtaining medical records.

- 3If the insurance company denies the claim, a business owner can appeal that decision and must submit written notification within 30 days; the dispute resolution process involves mediation and/or administrative hearing with 90 day timeline; if parties cannot agree resolution they can go to court.

- 4Consider seeking a second opinion in regards to your commercial insurance claim – the attorneys at Herman & Wells specialize in Florida insurance disputes and offer free consultations and claim reviews.

In this blog post, we will cover what it takes to navigate commercial insurance claims & disputes in Florida so you know exactly what to expect from start to finish. At Herman & Wells, our Florida insurance dispute attorneys are dedicated to helping business owners like you protect their financial interests when dealing with Florida insurance companies.

Our attorneys have an in-depth understanding of Florida’s laws and will work hard to ensure that you receive a fair settlement in the shortest amount of time possible. We are here to provide you with the legal advice and support needed to reach a favorable outcome for your Florida insurance claims and disputes. Contact us today to learn more.

Florida’s Commercial Insurance Claim Filing Process

What Is The First Step In Filing A Commercial Insurance Claim In Florida?

The first step in filing a commercial insurance claim is to contact your insurance to report the incident. Florida has a specific timeline for reporting insurance claims, so it is essential that you contact your insurance provider as soon as possible to begin the process. Your Florida insurance company will then review your claim and determine whether or not they can issue coverage for your losses.

What Information Must Be Included In The Claim?

When filing a Florida commercial insurance claim, you must provide certain information including the date and time of the incident, an explanation of your loss or injury, photos or documents about your property damage, medical records pertaining to any injuries, and proof that the incident was covered by your Florida policy. In some cases, you may also need to present witness statements or video evidence to support your case.

What Is The Statute Of Limitations For Filing A Commercial Insurance Claim In Florida?

The Florida statute of limitations for filing a commercial insurance claim is four years from the date of the incident. This means that if you fail to file a Florida insurance claim within four years, your case may be ineligible for coverage in which case you could be liable for any damages or claims related to the incident.

How Insurance Companies Investigate Commercial Claims In Florida

Once you have filed an insurance claim, Florida insurance companies will begin their own investigation into the incident to determine its validity.

What Happens After The Claim Is Filed?

Once your Florida insurance company has completed their investigation, they will make a decision on whether or not to provide coverage for the incident. If your claim is approved, your Florida insurance company will begin the process of negotiating and settling the claim with you or any other parties involved. This includes determining the amount of payment to be awarded and addressing any disputes over the claim.

What Is The Role Of The Insurance Company During The Investigation Process?

Florida insurance companies must act in good faith during the investigation process and take all reasonable steps to ensure that the claim is properly evaluated. This includes gathering evidence, interviewing parties involved, and obtaining necessary medical records. Florida insurance companies must also communicate with you regarding their decision throughout the entire process so that you remain informed of any developments.

What Is The Role Of The Policyholder During The Investigation Process?

As a Florida policyholder, it is important that you remain involved in the investigation process. You must provide all of the necessary information and documents to your Florida insurance company and respond promptly to any requests for additional information.

The Timeline For Commercial Insurance Disputes

What Happens If The Insurance Company Denies The Claim?

If Florida insurance companies deny a commercial insurance claim, the business owner can dispute the decision. In Florida, insurance disputes are required to follow a specific timeline to ensure that the process is fair and transparent for all parties involved.

What Are The Options For Resolving Disputes, Including Mediation And Litigation?

In Florida, business owners have two options when it comes to resolving insurance disputes: mediation and litigation. Mediation is a less formal process than litigation and involves using an impartial mediator to help the parties reach a resolution. Litigation is typically more expensive and time-consuming but can be necessary if the dispute cannot be resolved through mediation.

What Is The Timeline For Resolving Disputes Through Mediation Or Litigation?

The first step in disputing an insurance claim denial is to submit a written notification of appeal or grievance. This notification must state the reasons for the appeal and be sent to the insurance company within 30 days of receiving notice of the denial.

The Florida Office of Insurance Regulation also provides businesses with a dispute resolution process which includes mediation, if requested by either party or an administrative hearing. Both parties have 90 days from when a written notification has been filed, to reach a resolution.

If the two parties cannot agree on an outcome within 90 days, Florida insurance regulations allow for the dispute to go to court. The timeline for litigation can vary but typically involves a pre-trial period where both sides exchange evidence, as well as a trial phase and post-trial motions and appeals.

Options For A Second Opinion

If you’re in Florida and are dealing with an insurance claim or dispute, you may want to get a second opinion.

Why Would A Business Owner Want To Get A Second Opinion On Their Commercial Insurance Claim?

Having another expert review your case can provide valuable insight and help ensure that your rights are being fairly represented. A second opinion can also provide helpful advice on how to effectively manage the legal process, which can help you reduce your risk and maximize your potential rewards. A Florida insurance dispute attorney may be able to provide an independent evaluation of your case and suggest strategies that are best suited to resolve the dispute quickly and efficiently.

How Can A Business Owner Obtain A Second Opinion On Their Claim?

If you’re looking for a Florida insurance dispute attorney who can provide an independent evaluation of your case, there are a few options available. For instance, many attorneys offer free consultations and will be happy to discuss the specifics of your case with you. This is a great way to get an initial assessment of the dispute before deciding whether or not to hire an attorney.

You can also search online for Florida insurance dispute attorneys or Florida insurance claim experts who specialize in the area of law that is most applicable to your case. By doing so, you can easily find an attorney with experience handling similar cases and understand what steps may be necessary to resolve the dispute in your favor.

What Should A Business Owner Consider When Seeking A Second Opinion?

When seeking a Florida insurance dispute attorney or Florida insurance claim expert, it’s important to consider their qualifications and experience. Be sure to find an attorney who is familiar with Florida law as well as the specific legal issues surrounding your specific commercial insurance dispute. Additionally, make sure that the lawyer you choose is one you feel comfortable working with throughout the process.

If you’re in Florida and are dealing with an insurance claim or dispute, getting a second opinion can be a wise decision. Consider the aforementioned options to find the right Florida insurance dispute attorney or Florida insurance claim expert to help ensure your rights are appropriately defended.

When To Contact A Florida Insurance Dispute Attorney

What Is The Role Of An Insurance Dispute Attorney In The Commercial Insurance Claims Process?

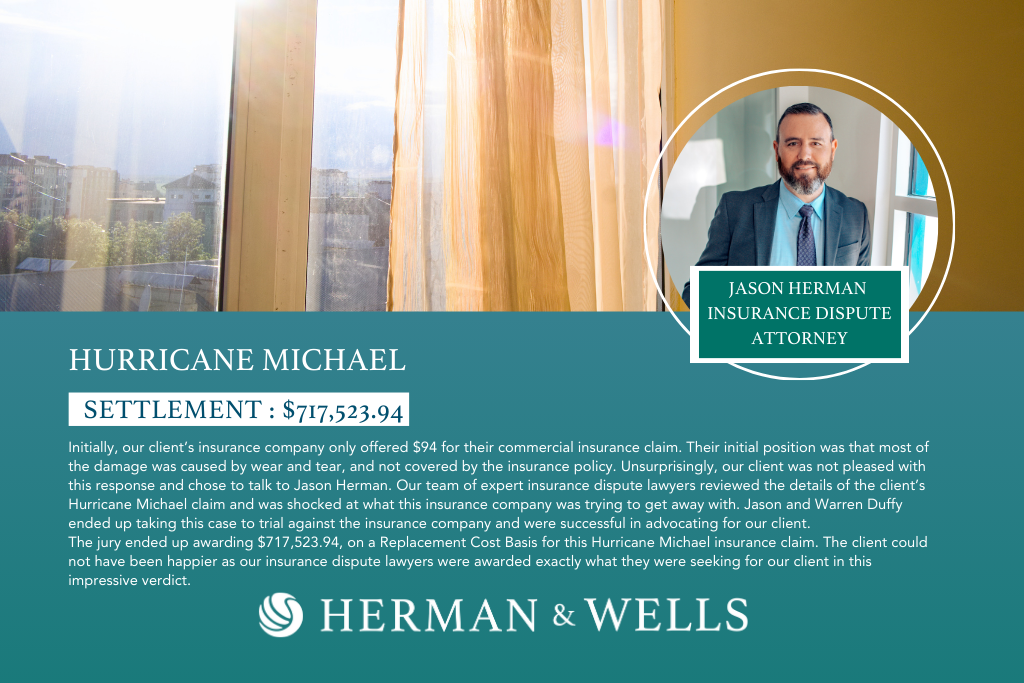

When an insurance claim is denied or there are disputes over the amount of coverage, Florida businesses often contact an experienced commercial insurance dispute attorney. A Florida insurance dispute attorney can assist with a wide range of complex commercial insurance claims and disputes. These professionals understand the nuances of Florida’s insurance regulations and have years of experience in successfully resolving commercial claim issues.

When Should A Business Owner Consider Contacting An Insurance Dispute Attorney In Florida?

As soon as a commercial insurance dispute arises, Florida business owners should consider speaking to an attorney who specializes in commercial claims. The sooner you have expert legal counsel on your side, the better your chances of recovering the full amount of coverage you are entitled to.

What Should A Business Owner Look For When Selecting An Insurance Dispute Attorney?

When selecting an attorney, Florida businesses should look for one with a successful record of resolving insurance disputes and claims. The lawyer should also have extensive knowledge of Florida’s commercial insurance regulations as well as the ability to construct effective arguments in favor of coverage or damages.

The Benefits Of Working With An Insurance Dispute Attorney With Trial Experience

What Is The Significance Of An Insurance Dispute Attorney With Trial Experience?

One of the benefits of working with an insurance dispute attorney Florida businesses should consider is that they have trial experience. This means that if a case cannot be resolved easily or amicably, then the attorney can aggressively represent you in court and get your claim resolved as quickly as possible. An experienced Florida insurance dispute attorney knows how to navigate Florida’s legal system.

How To Find An Insurance Dispute Attorney That Actually Has Trial Experience

Florida businesses should turn to reputable law firms and directories such as Florida Insurance Dispute Attorneys. Here, Florida business owners can find a comprehensive list of attorneys with trial experience in Florida’s insurance disputes and claims process. Florida businesses can also rely on the ratings and reviews of former clients to ensure they get the best legal representation available.

Want To Speak To An Attorney About Your Commercial Insurance Dispute? Call Herman & Wells

Understanding the timeline for commercial insurance claims in Florida are important for business owners and entrepreneurs who want to protect their investments. Knowing the specifics of Florida’s insurance laws and regulations can help business owners make informed decisions when it comes to filing a claim or dispute.

If you find yourself in Florida and have a dispute with your insurance provider, it’s important to consult an experienced commercial insurance attorney. At Herman & Wells, our attorneys are well versed in Florida insurance laws, and we can help navigate the complexities of an insurance claim or dispute. We provide personalized service to each client, offering advice from start to finish. Call (727) 821-3195 today for a free consultation on your commercial insurance dispute.