Pinellas Park Fire Damage Insurance Lawyers

“I had a dispute related to my home and was referred to Herman & Wells. Warren Duffy was the attorney who handled my case. Warren is one who stays on top of things and communicated with me on what was happening and explained the next steps through the process. He was accurate on every step of the process. I found the overall experience to be handled very professionally from the ease of getting stated to the final closeout and picking up my settlement check. I can highly recommend Herman & Wells and Warren Duffy and I would hire them again without any reservations.”

D Cab

Contact us for a free case evaluation

By submitting my data I agree to be contacted

TABLE OF CONTENTS

- WHY CHOOSE HERMAN & WELLS FOR YOUR FIRE DAMAGE CLAIMS IN PINELLAS PARK?

- COMMON CHALLENGES IN FIRE DAMAGE INSURANCE CLAIMS

- WHAT TO EXPECT WHEN WORKING WITH HERMAN & WELLS

- COMMON CAUSES OF FIRE DAMAGE IN PINELLAS PARK

- HOW TO FILE A FIRE DAMAGE INSURANCE CLAIM IN FLORIDA

- SHOULD YOU HIRE A PINELLAS PARK FIRE DAMAGE LAWYER BEFORE FILING YOUR CLAIM?

- THE STATUTE OF LIMITATIONS FOR FIRE DAMAGE INSURANCE CLAIMS IN PINELLAS PARK

- CONTACT OUR PINELLAS PARK FIRE DAMAGE INSURANCE LAWYERS

WHAT HAPPENED?

If you or someone you know has been affected by a fire in Pinellas Park, then it is important that you take the necessary steps to protect and secure your rights. Fire damage can be devastating in our community, leaving behind destroyed homes and businesses as well as emotional trauma for those impacted. As an experienced legal team of insurance lawyers serving Pinellas Florida residents, we are here to provide vital information about your options when it comes to filing a claim for fire damage-related losses.

Our fire damage insurance lawyers are highly trained in this area of law and will work diligently with you throughout the process, listening carefully to your situation and walking alongside you towards reaching the most favorable outcome possible. We understand how difficult it can be dealing with both physical and psychological destruction caused by a fire occurred at home or business – contact Herman & Wells today!

THE CLIFF NOTES

Get the key takeaways from this page

THE CLIFF NOTES

Get the key takeaways from this page

- Fire damage insurance claims involve several steps, including reporting the incident, gathering evidence, filling out claim forms, obtaining a fire report, cooperating with the insurance adjuster, reviewing the settlement offer, and appealing if necessary.

- Hiring a fire damage lawyer before filing your claim in Pinellas, Florida can increase your chances of a successful claim. Lawyers understand the complexities of fire damage claims and can ensure proper filing of all necessary documentation.

- The statute of limitations for fire damage insurance claims in Pinellas Park, Florida is two years from the date of the fire incident.

- If your claim is denied or underpaid, you have the right to appeal. Legal professionals can be instrumental in securing a fair settlement in such cases.

- Herman & Wells, a team of dedicated fire damage insurance lawyers in Pinellas Park, Florida, can guide you through the claims process, negotiate with insurance companies on your behalf, and represent your interests in case of appeal or legal action.

WHY CHOOSE HERMAN & WELLS FOR YOUR FIRE DAMAGE CLAIMS IN PINELLAS PARK?

Experienced Fire Damage Lawyers In Florida

Choosing Herman & Wells for your Fire Damage Claims in Pinellas Park ensures you’ll be represented by a team of highly experienced and dedicated professionals. Our team is deeply familiar with the intricacies of fire damage insurance claims in Florida, and we apply that expertise to every case we handle. We’re not just attorneys, we’re advocates who fight to ensure our clients get the compensation they deserve. Our client-first approach is designed to alleviate your stress during this challenging time, allowing you to focus on rebuilding and recovery.

Understanding Pinellas Park Fire Damage Insurance Policies

Understanding your fire damage insurance policy in Pinellas park is paramount in pursuing your claim successfully. These policies are often laden with complex language and specific conditions that can make navigating your claim a daunting task. However, our team has the expertise to interpret these policies and guide you through this process, ensuring you understand your coverage and rights. We aim to make this process as clear and straightforward as possible, empowering you to make informed decisions about your claim.

HOW WE CAN HELP WITH YOUR FIRE DAMAGE INSURANCE CLAIM

Evaluating Your Fire Damage Claim

Our first step in assisting you with your fire damage insurance claim is to conduct a thorough evaluation. We assess the extent of the damage, understand the specifics of your insurance policy, and calculate an accurate estimate of your loss. This diligent appraisal ensures that you are filing a claim that fully reflects the magnitude of your loss, a key step in getting the compensation you deserve.

Negotiating With Insurance Companies

In our role as your advocate, we take the helm in negotiating with insurance companies, a task that can often be arduous and tricky. Armed with a comprehensive understanding of your policy and the extent of your damages, we can take on the big insurance companies to fight for a fair and just compensation.

COMMON CHALLENGES IN FIRE DAMAGE INSURANCE CLAIMS

Underpaid Claims In Pinellas Park

An unfortunate, yet common issue in Pinellas Park is underpaid claims following a fire damage incident. Insurance companies may undervalue your loss in order to minimize their payout, leaving you unable to fully recover from the damages. At Herman & Wells, we challenge such unfair practices and passionately advocate for the full compensation you rightfully deserve.

Denied Fire Damage Claims In Pinellas Park

Another obstacle that Pinellas Park residents may face are outright denials of their fire damage claims by insurance companies. Such denials can be predicated on various reasons, many of which may be unjustified or contested. At Herman & Wells, we stand ready to challenge these denials, leveraging our expertise to overturn unjust decisions and ensure that you receive the justice and compensation you are entitled to.

WHAT TO EXPECT WHEN WORKING WITH HERMAN & WELLS

Personalized Legal Assistance

At Herman & Wells, we prioritize providing personalized legal assistance to our clients. We understand that each fire damage case in Pinellas, Florida has unique circumstances and challenges. Our dedicated team takes the time to understand your specific situation, tailoring our legal strategy to best suit your needs and maximize your potential claim.

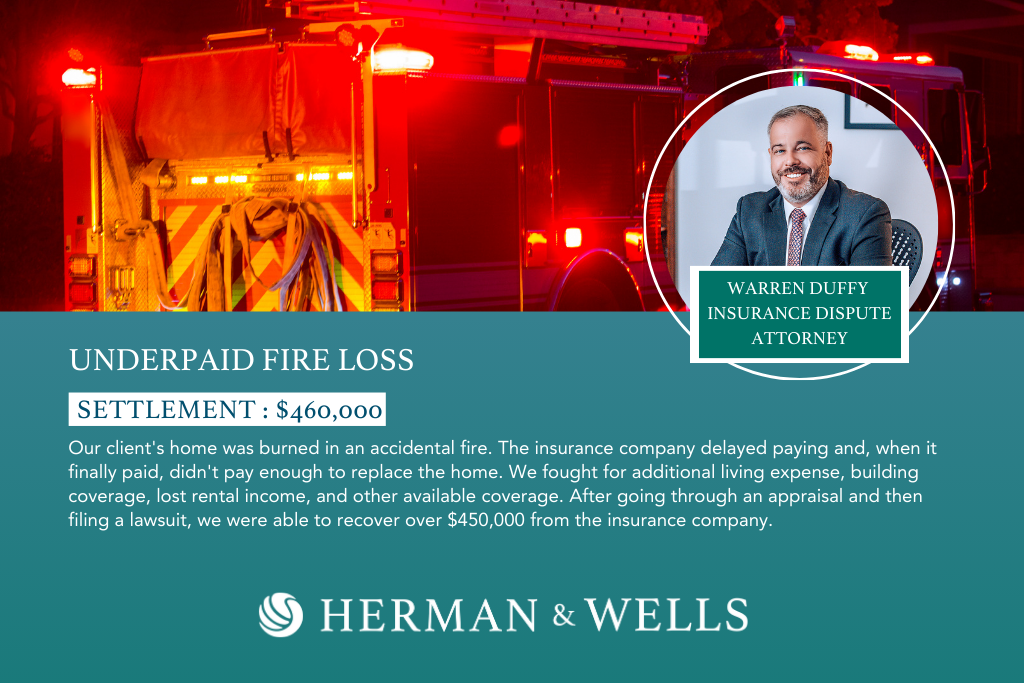

Proven Track Record In Fire Damage Cases

At Herman & Wells, we are proud of our proven track record in handling fire damage cases in Pinellas, Florida. Our extensive experience and strategic approach have resulted in numerous successful claims and significant recoveries for our clients. For instance, in one notable case, we secured over $450,000 in compensation after an insurance company initially underpaid a fire damage claim. Our victories are testament to our dedication, expertise, and unwavering commitment to fight for our clients’ rights.

COMMON CAUSES OF FIRE DAMAGE IN PINELLAS PARK

Fire incidents in Pinellas Park, Florida often arise from multiple sources, each posing a unique risk and requiring specific precautionary measures. Understanding these common causes can be essential in preventing future fire incidents and mitigating damage when they do occur.

COMMON CAUSES OF FIRE DAMAGE IN PINELLAS PARK

Fire incidents in Pinellas Park, Florida often arise from multiple sources, each posing a unique risk and requiring specific precautionary measures. Understanding these common causes can be essential in preventing future fire incidents and mitigating damage when they do occur.

Electrical Fires

These types of fires often result from faulty wiring, overloaded circuits, or malfunctioning appliances. Regular inspection and maintenance of electrical systems can significantly reduce the risk of electrical fires.

Kitchen Fires

A common cause of residential fires, kitchen fires often start due to unattended cooking, flammable objects near the stove, or grease buildup. Always monitoring food while cooking and keeping the cooking area clean and free of combustibles can help prevent these fires.

Heating Equipment Fires

Heating equipment like space heaters, fireplaces, and furnaces can cause fires if not used properly or maintained regularly. Ensuring these items have proper ventilation and are used according to manufacturer instructions can help to prevent fires.

Smoking-Related Fires

Smoking materials, such as cigarettes, are a leading cause of fire-related deaths in the United States. These fires often start when smoking materials are improperly discarded, catching onto flammable materials.

Wildfires

Pinellas Park, like many areas in Florida, is susceptible to wildfires, particularly during dry seasons. These fires are often caused by human activity or natural phenomena such as lightning. Adherence to fire safety guidelines during high-risk periods can help prevent these damaging fires.

HOW TO FILE A FIRE DAMAGE INSURANCE CLAIM IN FLORIDA

Filing a fire damage insurance claim in Florida can seem overwhelming, but understanding the process can greatly facilitate your journey towards compensation. Here, we outline a step-by-step guide to help you navigate this critical process effectively and efficiently.

Step 1: Contact Your Insurance Company

As soon as it’s safe to do so, reach out to your insurance company to report the incident. Timely reporting can expedite your claim process and potentially increase your chances of a successful claim.

Step 2: Document The Damage

Take photos and videos of the damage, and compile a detailed inventory of destroyed or damaged property. This documentation serves as crucial evidence in your claim and helps to accurately calculate your loss.

Step 3: Prevent Further Damage

Implement measures to prevent further damage to your property, such as covering broken windows or damaged roofs. Your insurance policy may require you to take such actions, and failure to do so could affect your claim.

Step 4: Complete the Claim Forms

Your insurance company will provide claim forms that require detailed information about the incident and the damage. Fill these out as accurately and thoroughly as possible to ensure your claim is appropriately evaluated.

Step 5: Obtain a Fire Report

A fire report from your local fire department provides an official record of the incident and can be a valuable piece of evidence in your claim. Request this report as soon as possible.

Step 6: Cooperate with the Insurance Adjuster

The adjuster’s task is to inspect the damage and estimate the cost of repair or replacement. Cooperating with the adjuster can facilitate a thorough and accurate assessment of your claim.

Step 7: Review the Settlement Offer

Your insurance company will present a settlement offer based on the adjuster’s report. Review this offer carefully and consult an attorney if it seems unreasonably low or if you have any doubts about your claim’s handling.

Step 8: Appeal if Necessary

If your claim is denied or underpaid, you have the right to appeal the decision. Enlisting the help of a legal professional in this case can be crucial in securing a fair settlement.

SHOULD YOU HIRE A PINELLAS PARK FIRE DAMAGE LAWYER BEFORE FILING YOUR CLAIM?

Hiring a fire damage lawyer before filing your claim in Pinellas, Florida can significantly increase the likelihood of a successful claim. Experienced attorneys understand the complexities of fire damage claims and can ensure that all necessary documentation is properly prepared and filed. If you don’t hire a fire damage lawyer you run the risk of missing critical deadlines, inaccurately valuing your loss, or failing to provide sufficient evidence to support your claim.

THE STATUTE OF LIMITATIONS FOR FIRE DAMAGE INSURANCE CLAIMS IN PINELLAS PARK

It’s important to note that the statute of limitations for fire damage insurance claims in Pinellas Park, Florida is now two years. This means you have a two-year window from the date of the fire incident to initiate legal action. Failure to do so within this period may result in forfeiture of your right to recover any compensation.

CONTACT OUR PINELLAS PARK FIRE DAMAGE INSURANCE LAWYERS

When you’re dealing with the aftermath of a fire, every minute counts. The journey towards a fair settlement doesn’t have to be navigated alone. At Herman & Wells, our dedicated team of fire damage insurance lawyers in Pinellas Park, Florida, is here to guide you through the complexities of the claims process, ensuring all necessary documentation is faultlessly prepared and submitted within the statute of limitations.

Our extensive experience and comprehensive understanding of fire damage claims mean we are excellently positioned to represent your interests, whether that involves negotiating with insurance companies, appealing an underpaid claim, or even initiating legal action. Our goal is to simplify the claims process for you, allowing you to focus on recovery and rebuilding, while we focus on securing the compensation you deserve.

Contact our Pinellas Park Fire Damage Insurance Lawyers at Herman & Wells today and take the first step towards a successful settlement! Call (727) 821-3195 to schedule a free consultation today.

CONTACT OUR PINELLAS PARK FIRE DAMAGE INSURANCE LAWYERS

When you’re dealing with the aftermath of a fire, every minute counts. The journey towards a fair settlement doesn’t have to be navigated alone. At Herman & Wells, our dedicated team of fire damage insurance lawyers in Pinellas Park, Florida, is here to guide you through the complexities of the claims process, ensuring all necessary documentation is faultlessly prepared and submitted within the statute of limitations.

Our extensive experience and comprehensive understanding of fire damage claims mean we are excellently positioned to represent your interests, whether that involves negotiating with insurance companies, appealing an underpaid claim, or even initiating legal action. Our goal is to simplify the claims process for you, allowing you to focus on recovery and rebuilding, while we focus on securing the compensation you deserve.

Contact our Pinellas Park Fire Damage Insurance Lawyers at Herman & Wells today and take the first step towards a successful settlement! Call (727) 821-3195 to schedule a free consultation today.

By submitting my data I agree to be contacted