Are you a Florida business owner dealing with a commercial insurance dispute? Trying to navigate the complexities of such disputes can be difficult, especially when commercial claims require special attention due to the high stakes involved. That’s why it pays to work with an experienced Florida insurance dispute attorney who understands all sides of these types of cases and has insider knowledge about how particular insurance companies operate in your state.

In this blog post, we’ll explore what a Florida insurance attorney does as well as discuss some key considerations for anyone considering hiring one for their commercial claim case. So let’s dive in and find out more!

The Cliff Notes: Key Takeaways From This Post

- 1Attorneys will examine all evidence related to your commercial insurance case, such as photographs, witness statements and medical records.

- 2An experienced insurance dispute attorney will negotiate on your behalf to help you receive the maximum compensation for your insurance claim.

- 3In some cases, it may be necessary to file a lawsuit in order to pursue your claim and an experienced attorney can represent you through the process.

- 4It is important to report your claim as soon as possible in order to remain within the time limits set by Florida law.

- 5Hiring an experienced attorney can help protect your right to recover any compensation for your losses.

Understanding Florida Commercial Insurance Claims

Commercial insurance policies are designed to provide protection for businesses operating in Florida. When a business experiences an unexpected loss, filing a commercial insurance claim can help provide financial relief and security. In Florida, commercial insurance claims can help business owners recover from a variety of losses, including but not limited to property damage and liability.

Common Reasons For Denial Of Commercial Insurance Claims In Florida

Unfortunately, not all commercial insurance claims are approved. Common reasons for denial include:

- Unforeseen losses or damages that were not covered by the policy

- Insufficient proof of the validity of the claim

- Filing an incomplete or incorrect claim

Legal Rights Of Florida Business Owners In Commercial Insurance Claims

Business owners have the right to dispute any denied claims or delayed payments and should contact an experienced insurance attorney for assistance. It is also important to understand that insurers must act in good faith and treat their policyholders fairly when handling claims.

Hire An Experienced Attorney In Florida To Handle Your Commercial Insurance Dispute

Knowledge Of Florida Insurance Law And Regulations

Experienced insurance attorneys are familiar with Florida insurance laws and regulations that pertain to your unique situation. This knowledge can be crucial in helping you maximize your recovery for any losses or damages that you have sustained.

Familiarity With Florida Insurance Companies And Adjusters

Insurance lawyers understand the tactics and strategies used by insurance companies and adjusters. They can provide helpful advice on how to proceed with a claim, when to negotiate for increased coverage, or when to file a lawsuit if necessary.

Experience Handling Insurance Disputes In Florida

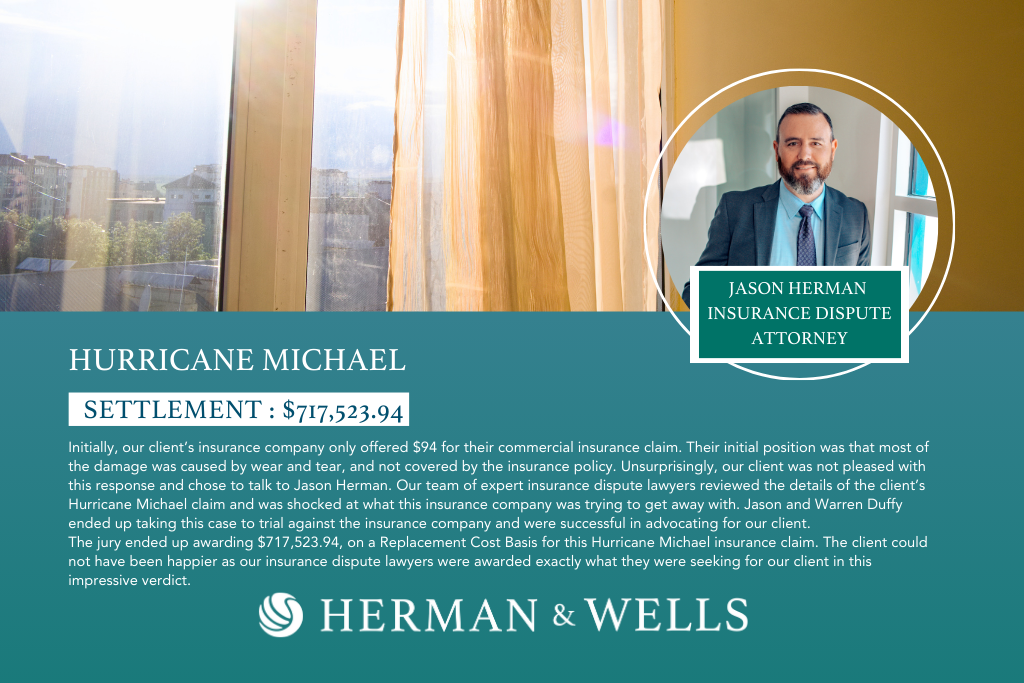

Our team of attorneys has extensive experience handling commercial insurance disputes. After years of going up against major insurance companies, they are extremely well-versed in the dispute process and know what needs to happen in order to reach a successful resolution for our commercial clients.

Ability To Negotiate And Litigate Insurance Claims In Florida

Negotiation and litigations can be a tedious process, and an experienced insurance attorney can help business owners navigate these complex legal proceedings. Insurance attorneys understand the intricacies of commercial insurance claims in Florida and can work to ensure their clients receive fair settlements or verdicts.

How An Experienced Insurance Dispute Attorney Can Help You In Florida

Reviewing Your Commercial Insurance Policy

An experienced insurance dispute attorney in Florida can review your policy to make sure that you are receiving full coverage for your losses. This review will take into account the specific language of the policy, your rights and duties under the contract, any exclusions or limitations listed in the policy, and other important legal factors.

Investigating The Facts And Circumstances Of Your Claim

When filing a commercial insurance claim in Florida, an experienced attorney can investigate the facts and circumstances surrounding the claim in order to determine whether or not it is valid. Attorneys will examine all evidence related to the case such as photographs, witness statements, repair estimates, medical records, and other relevant documents.

Communicating With The Insurance Company And Adjuster On Your Behalf

It is important to have an experienced attorney handle all communication with the insurance company and adjuster. An attorney can communicate with the adjuster in a professional manner to ensure that all legal issues are addressed.

Negotiating A Fair Settlement Of Your Claim

If a settlement can be reached, an experienced insurance dispute attorney will negotiate on your behalf to ensure that you receive maximum compensation. An attorney can help evaluate the offer and advise you if it is fair or not.

Filing A Lawsuit To Pursue Your Claim In Court, If Necessary

In some cases, it may be necessary to file a lawsuit in order to pursue your claim. An experienced insurance dispute attorney will protect your rights and interests by filing the appropriate paperwork with the court and representing you throughout the lawsuit process.

The Importance Of Acting Quickly And Hiring An Experienced Attorney In Florida

The Importance Of Timely Reporting Of Your Claim

It is important to report a commercial property insurance claim as soon as possible in order to make sure that you are within the time limits set by Florida law. Failing to timely report a claim may limit or completely bar you from recovering any compensation.

The Statute Of Limitations For Filing A Claim In Florida

In Florida, it’s important to keep in mind that the statute of limitations for submitting a commercial insurance claim is limited to four years starting from the date of the incident. This means you NEED to file your insurance claim within this time frame, as failure to do so can make your case ineligible for coverage. In such a scenario, you may be held responsible for any damages or claims arising from the incident.

The Importance Of Acting Quickly To Preserve Evidence And Collect Witness Statements

It is also important to act quickly to preserve evidence and locate witnesses. Evidence can be lost, destroyed, or become unavailable with time, and the memories of witnesses can fade. A good commercial insurance dispute attorney can help you gather all the necessary evidence and build a strong case for your claim.

The Risk Of Losing Your Right To Recover If You Delay Hiring An Attorney

Finally, it is important to act quickly and hire an experienced insurance dispute attorney in Florida in order to preserve your right to recover any compensation for your losses. Failing to do so may put you at risk of forfeiting this right entirely. Hiring an attorney to handle your commercial claim gives you the absolute best chance of receiving full compensation.

Don’t Fight Alone, Call Herman & Wells

Facing an insurance dispute can be a stressful process for business owners in Florida. When it comes to commercial insurance claims, you don’t have to fight alone. At Herman & Wells, our team of attorneys is well-versed in insurance disputes and has represented countless businesses throughout the state of Florida.

Our experienced insurance dispute attorneys can review your policy, investigate the facts and circumstances of your claim, communicate with the insurance company on your behalf, negotiate a fair settlement or verdict for your case, and pursue litigation if necessary. Don’t delay – call (727) 821-3195 today for your free consultation and get the help you need.