It’s been six months since Hurricane Ian swept through the Atlantic causing devastation in its wake, and for many Florida residents, the process of rebuilding still hasn’t begun. Numerous homeowners and business owners have been drastically lowballed by insurance companies, delaying home repair. The Washington Post reports that many insurance claims stemming from Hurricane Ian have been underpaid by more than 80%.

Insurers are fraudulently minimizing payouts far below damage estimates or denying claims altogether. This means that many residents whose properties were damaged or even completely destroyed by hurricane Ian may not be able to restore them due to inadequate compensation for their losses.

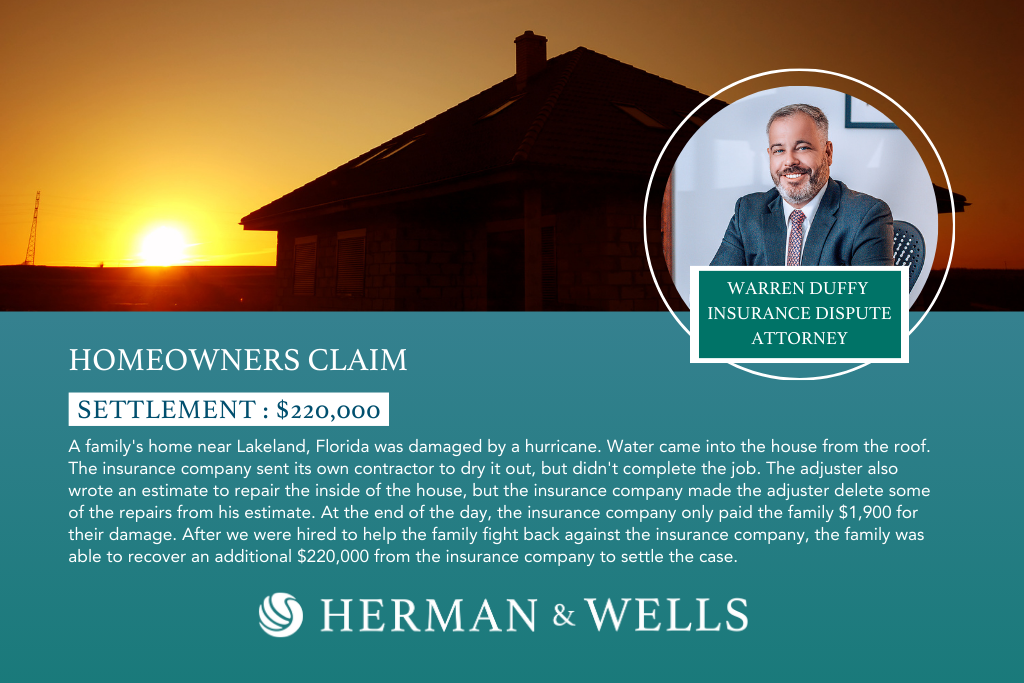

If you’ve recently grappled with a payout far less than you expected or wrongfully denied an insurance claim in light of your damages from Hurricane Ian, you have to take legal action. Contact the insurance dispute lawyers of Herman & Wells and we’ll help you fight for the full amount of compensation you’re entitled to.

In this blog post, we’ll take a closer look at what the insurance companies are up to and what is being done to put an end to their fraudulent activities. We’ll also discuss the legal options available for Florida residents who have been taken advantage of by their insurers.

The Cliff Notes: Key Takeaways From This Post

- 1Florida residents are still grappling with the aftermath of Hurricane Ian, and there is an urgent need for greater transparency and accountability in Florida’s hurricane insurance claims process.

- 2Florida hurricane insurance companies and third-party adjusters are facing scrutiny due to allegations of fraud and collusion in Hurricane Ian claims.

- 3Republicans are passing laws that protect insurance companies from being sued by policyholders.

- 4If Florida residents have been wrongfully denied an insurance claim or low-balled after hurricane Ian, they should consider legal action and speak to a qualified insurance dispute lawyer immediately.

- 5Do you have a grossly undervalued or rejected Hurricane Ian insurance claim? The experts at Herman & Wells can help you fight for the full amount of your deserved compensation. Don’t wait, call us at (727) 821-3195.

How Claims Are Handled In Florida

The first step in the claims process is to gather essential Florida hurricane insurance information. This includes details of your policy, the date and magnitude of the storm, and the damage that has occurred. Once you have this information in hand, you can contact your Florida hurricane insurance provider to begin the claims process.

After contacting your insurance, they will send out an adjuster who will assess all available evidence to determine whether it is liable for any damages. During the assessment, they will take photos and notes, analyze your hurricane insurance policy, and review other information such as estimates of damage costs.

The adjuster then works with your Florida hurricane insurance provider to determine how much coverage you are eligible for. This can vary depending on various factors such as your home’s pre-existing conditions, the nature of the storm, and any applicable Florida statutes.

Once your Florida hurricane insurance claim is approved, you will receive a settlement offer. If the insurance company is being fair, this amount will cover all damages.

Third-Party Adjusting Firms And Their Role

These firms can offer independent assessments of damage and provide a more objective take on the situation. During the claims process, it is not unusual for third-party adjusters to collaborate with insurance companies in order to make minor revisions and even change line items if there is proof that damage had happened before the event.

Florida Insurance Companies’ Financial Incentive To Minimize Payouts

Insurance companies may have a financial incentive to minimize payouts, as they are looking to maximize profits and cut costs. This leads to them undervaluing or denying hurricane insurance claims, which most Florida homeowners are already all too familiar with.

Allegations Of Fraud And Collusion

The Washington Post reported that there are now allegations of fraud and collusion between Florida insurance adjusters and Florida hurricane insurance companies:

Adjusters Speak Out About Fraudulent Practices

Ben Mandell and Mark Vinson – two highly experienced independent adjusters – began working for Florida Peninsula Insurance Co to assist with the influx of Hurricane Ian insurance claims. Within weeks of being hired, they started noticing strange behavior from the insurers.

They witnessed credible claims receiving rejections or not being processed in some cases – which further delayed necessary payouts to people who had already been significantly impacted by Hurricane Ian. The adjusters also noticed the same or similar edits were cropping up, regardless of where homes had been built and at what time. This strange pattern has caused homeowners to be denied roof repairs.

Evidence Of Collusion Between Florida Insurance Companies And Third-Party Adjusters

Insurance carriers are accused of undervaluing payouts by instructing independent adjusting firms to use tactics that would reduce overall payout amounts. Evidence shows how the companies have gone so far as issuing emails, dictating exactly what write-ups should be used in order for policyholders to receive significantly less money than they deserve.

Pressure On Adjusters To Alter Damage Reports

It is common for Insurance companies to set guidelines for third-party contracting companies to follow when helping out with major disasters. These guidelines dictate how much the insurer believes should be allocated for that storm, what it will cover, and how to describe and document the damage. Through emails collected by The Post, both Tristar and a third-party adjusting firm discussed these arrangements.

Adjusters at Tristar were given suspicious guidelines -being specifically told not to say that “wind” was the cause of damage in reports after Hurricane Ian. Insurance companies offer wind damage policies, which could lead to larger payout amounts. Mandell was terminated after expressing his disagreement with the revisions being made to his reports.

Industry Protections And Legislation

Florida Republicans Pass Laws Protecting Insurance Companies

In Florida, Republicans passed laws that protect insurance companies from being sued by policyholders. This means homeowners have little to no recourse when it comes to disputed claims.

Impact Of Legislation On Homeowners And Their Ability To File Claims

These laws not only protect Florida insurance companies from lawsuits, but they also limit the power of Florida homeowners who are trying to fight for fair payout amounts. As a result, Florida homeowners may feel powerless when it comes to filing successful claims due to insurance companies holding all of the cards.

Calls For Action in Florida

Adjusters Speak Out To Lawmakers

As Florida residents and business owners try to rebuild after Hurricane Ian, adjusters such as Jordan Lee, Ben Mandell, Mark Vinson, and others adjusters have sought out Florida Rep. Bob Rommel (R) in an effort to bring attention to their accusations of fraudulent insurance companies. In response, Rep. Rommel asked the adjusters to present evidence in his office so he could ensure that both Florida’s Attorney General and Office of Insurance Regulation would investigate the claims.

Evidence Presented To Florida Rep. Bob Rommel

In support of these allegations, Mark Vinson provided a flash drive containing various documents; however, the representative noted it was not secure for use on government computers.

On December 14th, an email was sent by Mandell to Rommel’s office with evidence regarding the damage incurred. These documents included a file that revealed how the original cost estimation of $40,468.54 had been revised to only $2,658 – a drastic difference. Notably, the adjuster’s name had remained on this document, leading to suspicions within Florida’s insurance industry that fraudulent activity may have been at play.

Rommel informed The Washington Post through an email that the adjusters who came to his office had failed to provide any form of evidence. In response, Rommel allowed them to enter his office if they could present some proof. After several emails from The Post, Rommel’s office indicated that their email had already been sent to Florida’s Chief Financial Officer Jimmy Patronis and that he would be in touch with Mandell.

Ongoing Investigation Into Fraudulent Practices

This story is part of Florida’s larger narrative when it comes to the insurance claims from Hurricane Ian in 2023. After months of battle, many homeowners are still struggling to get their claims processed and approved so they can repair the damage left by the storm.

A representative of Rommel declared that they had requested the CFO’s office to keep them updated. In response, an official statement was released which stated that they have received details from Rommel and held a meeting with property owners based on these findings. They claim that “an investigation is currently open and ongoing.”

Florida Homeowners In Limbo

According to The Washington Post, four homeowners declared that they received a fraction of what their Heritage and Florida Peninsula determination letters stated – or were receiving mixed responses from the insurers. Until they get some kind of resolution, their homes remain intensely damaged or inhabitable. While a whopping 33,000 Florida homeowner claims associated with Ian remain open and unpaid, an even larger number of 125,000 were closed without payment.

The Impact Of Fraudulent Practices On Florida Homeowners

As Florida residents continue to grapple with the aftermath of Hurricane Ian, there is an urgent need for greater transparency and accountability in Florida’s hurricane insurance claims process. The effects of these fraudulent practices are devastating for homeowners, potentially making many Floridians financially destitute, and having to bear the brunt of repair costs.

The Sebastians’ Story

Terry and Mary Sebastian’s canal home in Rotonda West, Fla. was heavily damaged by Hurricane Ian, leaving piles of insulation everywhere and an unbearable smell of the rain-soaked carpet. The 150 mph winds left debris strewn throughout–from roof debris scattered in the yard to broken screens surrounding a pool filled with palm fronds. Jordan Lee, the adjuster mentioned earlier, estimated that it would require $200,000 for repairs such as dehumidifying the home, replacing the roof and gutters, and tearing out old insulation.

Lee was shocked to learn that his original report had been significantly reduced without any input from him and without his consent. Instead of having all of their damages taken care of, now only half of the necessary insulation repairs were proposed, with one-third replacement; all while his name remained on the final report. The estimated funds allocated for these changes amounted to $27,000.

Uncertainty Over Insurance Payouts

The Sebastians are now left with no clear answers about what the Florida insurance companies will do to make them whole. Florida homeowners like the Sebastians worry that Florida hurricane insurance claims may not be handled fairly or in good faith. Florida politicians have passed legislation designed to protect Florida insurance companies from having to pay out on too many claims, and this has resulted in homeowners like the Sebastians feeling trapped and helpless.

Was Your Hurricane Ian Claim Underpaid? Call Herman & Wells

The Florida insurance industry has long been in need of reform. Protecting Florida homeowners’ rights should be one of the most important objectives for Florida legislators. Yet Florida homeowners are facing an uphill battle to receive fair and timely payments on their hurricane insurance claims. Florida legislators too often prioritize the interests of Florida insurance companies over those of Florida homeowners and pass laws that make it difficult for Florida homeowners to receive fair and timely payments to rebuild their home and their lives.

Do you have a grossly underpaid or rejected Hurricane Ian insurance claim? Contact our hurricane Ian insurance lawyers at Herman & Wells to review your claim and help you get the payout that you deserve. We have over 20 combined years of experience advocating for Florida homeowners to receive the compensation that they are entitled to and fight hard to ensure that insurance companies don’t get away with underpaying Florida homeowners.

Let our experienced attorneys help you! Don’t wait, call us at (727) 821-3195 for a free consultation today!