Seminole Fire Damage Insurance Lawyers

Experiencing a fire incident can be traumatic, and the subsequent challenges of fire damage insurance claims can exacerbate the distress. In Seminole, Florida, where such incidents are unfortunately not uncommon, you need a skilled and experienced partner to navigate the complexities of insurance disputes. That’s where we, at Herman & Wells, step in. We have an exceptional track record in dealing with fire damage insurance disputes, ensuring our clients receive the fair compensation they are entitled to.

Don’t allow yourself to be overwhelmed by the process. Contact us today to schedule a consultation with our proficient fire damage insurance lawyers. Let us shoulder the burden so you can focus on rebuilding and recovery.

The Cliff Notes: Key Takeaways From This Page

- If your fire damage insurance claim was denied, it could be due to insufficient documentation, policy exclusions, late reporting, discrepancies between the claim and policy coverage, or non-payment of premiums.

- Working with a skilled fire damage insurance lawyer is essential in navigating the complex landscape of Seminole’s insurance laws and securing fair compensation for your losses.

- Legal representation provides advocacy and negotiation with insurance providers, assurance of rightful compensation, and expertise in handling the claim process.

- Don’t hesitate to reach out to our experienced team at Herman & Wells for expert counsel and support in your fire damage insurance dispute. We are here to fight for you and help you get the compensation you rightfully deserve. So don’t wait any longer – contact us today!

Most Common Causes Of House Fires In Seminole

Undeniably, understanding the common causes of house fires in Seminole can significantly aid in prevention and preparedness. Let’s delve into the key factors contributing to these devastating incidents.

Electrical Faults

Electrical faults are a leading cause of house fires. This can be due to faulty or outdated wiring systems, overloaded circuits, or improper use of electrical appliances. Regular inspections by certified electricians can mitigate these risks.

Cooking Accidents

Unattended cooking is another significant factor contributing to house fires. Distractions can easily lead to overheating, spills, and ultimately, a fire. It’s crucial to always monitor cooking activities closely, especially when using high heat.

Heating Equipment

Improper use or maintenance of heating equipment, especially during the colder months, can lead to fires. Space heaters, in particular, can pose a risk when placed too close to flammable materials. Regular maintenance, proper use, and adequate safety measures can avert such instances.

Smoking Indoors

Fires caused by smoking indoors often result from lit cigarettes coming into contact with flammable materials such as upholstery, bedding, or curtains. It’s advisable to smoke outdoors or ensure cigarettes are completely extinguished.

Candles

While they may create a cozy ambiance, unattended candles can lead to disastrous consequences. Always extinguish candles before leaving a room and keep them away from flammable materials.

Understanding these causes and implementing appropriate safety measures can go a long way in preventing house fires. However, if a fire does occur, our team at Herman & Wells is ready to assist you with your fire damage insurance claim.

Immediate Steps To Take After A Fire

Taking immediate and appropriate steps after a fire can alleviate the stress and expedite your fire damage insurance claim process. Here is a step-by-step guide to help you navigate the aftermath of a fire:

1. Ensure Safety

Your safety and that of others is paramount. Once the firefighters have extinguished the fire, ask them if it’s safe to re-enter the house. Be cautious of any structural damages that may pose a risk.

2. Report The Incident To Insurance Company

Contact your insurance company as soon as possible to report the fire. Provide them with all the necessary details and initiate your fire damage insurance claim. Quick reporting can expedite the claims process.

3. Document The Damage

Take photographs and make a detailed list of all damaged items. This documentation will serve as crucial evidence when negotiating your claim.

4. Secure Your Property

To prevent further damage, secure your property if it’s safe to do so. This might involve boarding up windows or covering a damaged roof to protect it from weather damage.

5. Begin Restoration Process

Once your insurance claim is underway, start the restoration process. Hire professionals to clean and restore your property, ensuring it’s safe for habitation.

The Aftermath of Fire Damage in Seminole

Impact on Homeowners and Businesses

The aftermath of a fire significantly affects the lives of homeowners and businesses in Seminole, Florida. Alongside the physical damage, the emotional toll can be overwhelming, disrupting daily routines and livelihoods. The urgent need to file and process fire damage insurance claims adds to the stress, often creating a feeling of uncertainty. It’s important to remember, during these trying times, that help is available, with experienced legal professionals ready to guide you through the complexities of the claims process.

Dealing With Fire Damage Insurance

Navigating fire damage insurance claims in Seminole, Florida can be a daunting task. It involves understanding complex policy details, accurately assessing the damage, and negotiating with insurance companies. These companies often employ tactics to minimize payouts, leaving homeowners grappling with inadequate compensation to cover their damages. This is where an experienced fire damage insurance lawyer can be instrumental. We at Herman & Wells have the expertise to tackle these challenges, advocating for your rights, and ensuring you get the fair compensation you deserve.

The Vital Role of Fire Damage Insurance

Fire damage insurance plays a pivotal role in providing a safety net for property owners in Seminole, Florida. It covers the cost of repair or rebuilding work following a fire, alleviating the financial burden homeowners might otherwise face. However, the process of claiming this insurance can be complex and daunting. This makes it crucial for homeowners to understand their insurance policy thoroughly and to seek professional legal assistance if necessary, to ensure they obtain the compensation they are rightfully owed. Don’t leave your financial future to chance; get the support you need to navigate the fire damage insurance claim process effectively.

How Our Seminole Insurance Lawyers Can Help Fire Damage Claim Process?

At Herman & Wells, our dedicated attorneys offer comprehensive support throughout the fire damage claim process in Seminole, Florida. With a wealth of knowledge and experience, we are well-equipped to deal with insurance providers, ensuring that they fully honor your policy. We are committed to securing the maximum compensation on your behalf, providing the financial resources necessary to rebuild and recover after a devastating fire. Don’t face the insurance companies alone; let our skilled team be your trusted ally in this challenging journey.

Your Fire Damage Insurance Claim Was Denied? Here’s Why:

Discovering that your fire damage insurance claim has been denied can be a devastating blow, especially in the wake of the trauma and loss caused by a fire. Let’s explore some common reasons insurance companies in Seminole, Florida might deny a fire damage claim:

Insufficient Documentation

One common reason for the denial of fire damage insurance claims is insufficient documentation. Insurance companies require detailed records of damaged items, including photographs, purchase receipts, and any other relevant evidence that substantiates your claim. If this documentation is lacking, incomplete, or unconvincing, the insurance company may deny the claim.

Policy Exclusions

Every insurance policy includes certain exclusions, which are specific situations or types of damage that the policy does not cover. For example, if a fire is found to be caused by homeowner negligence or if it involves certain types of property specifically excluded in your policy, your claim may be denied.

Late or Inaccurate Claim Reporting

Insurance companies have strict requirements regarding the time frame within which a claim must be reported. If you fail to report your claim promptly or provide inaccurate information during the reporting process, the insurance company may use this as a reason to reject your claim.

Discrepancies Between Claim and Policy Coverage

Your claim might be denied if there is a discrepancy between the claim and your policy coverage. For instance, if the cost of damage exceeds your policy limit or if you’re claiming for items or damages not covered under your policy, this could lead to denial.

Non-Payment of Premiums

Non-payment or late payment of insurance premiums can lead to the cancellation of your policy, thereby causing the denial of any claims made thereafter. It’s crucial to keep track of your premium payments and ensure they are made on time.

Remember, denial of a fire damage insurance claim doesn’t necessarily mark the end of your claim. You have the right to dispute the decision. Working with an experienced fire damage insurance lawyer can help you understand your options, navigate the appeals process, and fight for the compensation you’re entitled to.

Necessity of Legal Support in Fire Damage Insurance Disputes

Understanding Seminole’s Insurance Landscape

Seminole’s insurance landscape is complex, marked by intricate laws and guidelines unique to Florida. A seasoned fire damage insurance lawyer is well-versed in these local rules, thereby offering an indispensable advantage in insurance disputes. Their deep understanding enables them to translate legal jargon into layman’s terms, demystify complicated processes, and guide clients through the often convoluted claims process, ensuring they secure fair compensation.

Advocacy And Negotiation With Insurance Providers

Skilled legal representation is critical when dealing with insurance providers. Attorneys who specialize in fire damage insurance claims can effectively communicate and negotiate with insurers on your behalf. They can challenge lowball settlement offers, push back against unfair claim denials, and present compelling evidence to substantiate your claim. By employing strategic negotiation tactics, your lawyer can help you secure the compensation you need to recover from a disastrous fire event in Seminole, Florida.

Assurance Of Rightful Compensation

In securing proper fire damage compensation in Seminole, Florida, legal support is invaluable. A seasoned fire damage insurance lawyer not only understands the intricacies of insurance claims but also ensures your rights are upheld throughout the process. They scrutinize the fine print of your policy, validate your claim, and contest any unjust decisions, thereby providing assurance that you’ll receive the compensation you are rightfully entitled to. In the aftermath of a fire, let a professional handle your claim while you focus on rebuilding and recovery. Remember, having legal representation is not a luxury, but a necessity when up against insurance companies.

Get In Touch With Our Seminole Fire Damage Insurance Lawyers

As you face the aftermath of a fire disaster in Seminole, Florida, having a knowledgeable and aggressive fire damage insurance lawyer by your side can make a significant difference in your claim outcome. Our attorneys at Herman & Wells are committed to helping you navigate the complexities of the fire damage insurance claim process, ensuring you get the compensation you truly deserve. We understand what you’re going through and are ready to assist, providing the expert counsel you need during this difficult time.

Reach out to us, and let us help you secure the compensation you rightfully deserve. Call (727) 821-3195 to schedule a free consultation with us today and let us start that fight together!

Case Results

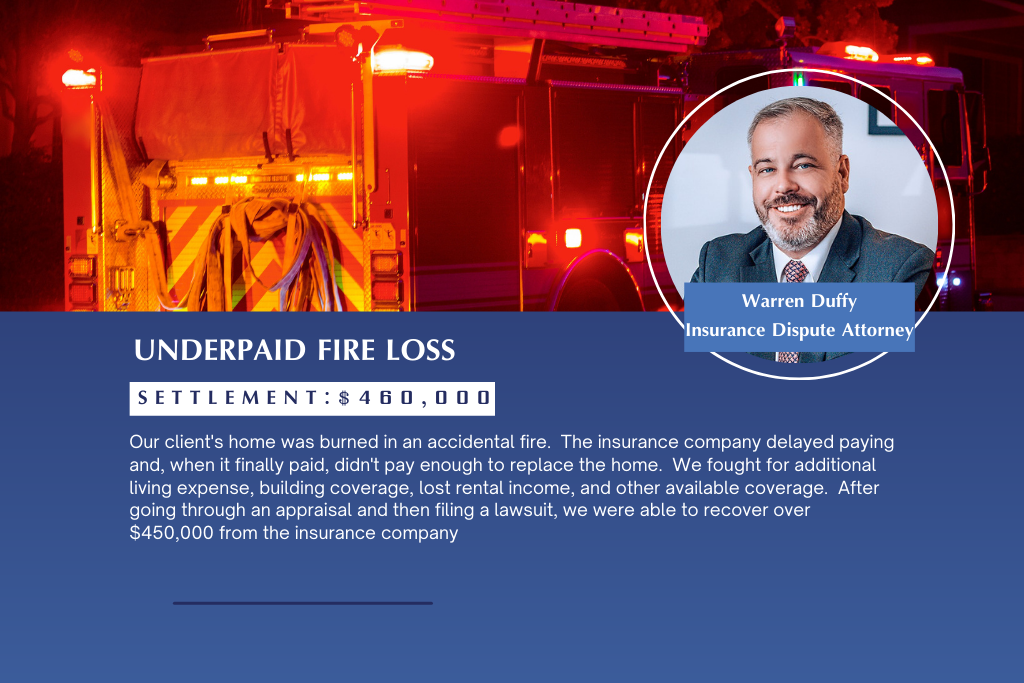

See More Case ResultsUnderpaid Fire Loss

A fire caused significant damage to our client’s house. The insurance company delayed paying and then paid much less than the cost of repair. We sued the insurance company and forced the insurance company to pay an additional $185,412.

Initial Position

Underpaid

$185,412.00

Underpaid Fire Loss

Our client’s home was burned in an accidental fire. The insurance company delayed paying and, when it finally paid, didn’t pay enough to replace the home. We fought for additional living expense, building coverage, lost rental income, and other available coverage. After going through an appraisal and then filing a lawsuit, we were able to recover over $450,000 from the insurance company.