Bradenton Water Damage Insurance Lawyers

If you’re a Florida resident who has suffered water damage to your property, then hiring a Bradenton water damage insurance lawyer can make all the difference. With years of experience handling cases like yours, our dedicated and highly skilled professionals are equipped to help you get the financial compensation for lost possessions and repairs that you deserve.

When it comes to navigating confusing policy language or protecting yourself from denials or lowballing by insurance companies, having an experienced lawyer on your side is invaluable. Contact our experienced water damage insurance lawyers in Bradenton today for a free consultation and find out how we can help you fight for your rights.

The Cliff Notes: Key Takeaways From This Page

- Bradenton water damage insurance lawyers offer expertise and advocacy to guide clients through the complex process of filing an insurance claim.

- These lawyers are well-equipped to battle against insurance companies and ensure fair compensation for property losses.

- When choosing a lawyer, it’s important to consider their local expertise, proven success in handling similar cases, and personalized approach towards each case.

- Frequently asked questions about water damage insurance in Bradenton are addressed, providing readers with helpful information and clarifying common concerns.

- Overall, hiring a local lawyer can greatly benefit your water damage insurance claim and increase the likelihood of a fair settlement. Contact us today for expert legal counsel and advocacy.

Understanding Water Damage In Bradenton Florida

Bradenton, situated on Florida’s west coast, has a unique geography and climate that can inadvertently contribute to water damage. Being a coastal town, it’s subject to heavy rainfall, especially during the hurricane season from June to November. This, coupled with the low-lying, flat terrain of much of Florida, can lead to frequent flooding.

Additionally, the high humidity and heat of Florida can exacerbate water damage, leading to the rapid growth of harmful molds and mildews in damp environments. Insurance claims for water damage in such areas are common, and understanding this context is essential while navigating the process.

Implications For Home And Business Owners

Water damage can have a profound impact on both the structural integrity and financial value of properties in Bradenton. Structurally, prolonged water exposure can weaken building materials such as wood and concrete, leading to potential hazards like mold growth, rot, and in severe cases, structural failure. This could affect the overall safety and liveability of the property.

From a financial viewpoint, these structural issues can significantly depreciate the value of your property. Moreover, repairs and remediations can be costly, often running into thousands of dollars. This doesn’t even take into account the potential loss of personal possessions, disruption to business operations, and increased insurance premiums that could result from a water damage claim.

Why Water Damage Insurance Is Crucial For Bradenton Residents

Given the high risk of water damage in Bradenton, having a comprehensive insurance policy that covers such damages is crucial. Unfortunately, even with an insurance policy in place, many residents still struggle to get fair compensation for their losses. Insurance companies often engage in tactics like denying claims, delaying payments, or offering low settlements to avoid financial liability.

Navigating Water Damage Insurance In Florida

What Your Insurance Typically Covers

The specific details of what your insurance policy covers and excludes can vary. However, most water damage insurance policies typically cover sudden or accidental damages, such as burst pipes, leaks, or storms. Additionally, they may cover the cost of repairs for damages to your property’s physical structure and personal possessions.

What Your Insurance May Not Cover

It’s crucial to carefully review your policy to understand what damages are not covered. In Florida, standard insurance policies may exclude coverage for damages caused by flooding or sewer backups. These particular exclusions put residents at risk, as these are common causes of water damage in the state.

When And How To File A Water Damage Insurance Claim

Notify Your Insurance Company Immediately

Upon detecting water damage, inform your insurance company without delay. Quick action is critical for filing a successful claim. Document the damage with photographs and detailed notes for future reference.

Start the Cleanup Process

While waiting for the insurance adjuster, start the cleanup process to prevent further damage. However, ensure you have enough evidence of the original damage.

File the Claim

Submit your claim as per your policy instructions. Include all documentation and proof of damage. Prompt filing can expedite the claim process, and it’s important to file within the time-frame stipulated in your policy.

Review Settlement Offer

Review the insurance company’s settlement offer carefully. If you disagree with the assessment, consider hiring an insurance lawyer in Bradenton to help negotiate a fair settlement.

Appeal a Denied Claim

If your claim is denied, you can appeal the decision. Hiring a water damage insurance lawyer can be beneficial in presenting a strong appeal. They can guide you through the complexities of insurance laws in Florida effectively.

The Crucial Role Of Bradenton Water Damage Insurance Lawyers

Advocacy And Expertise

In the challenging journey of insurance claims, specialized lawyers from Bradenton offer unparalleled guidance. Their deep understanding of Florida’s insurance laws, backed by years of hands-on experience, positions them to competently interpret policy terms and navigate claim procedures. They’re adept at ensuring your claim accurately represents the extent of your damages, thereby increasing the likelihood of receiving a fair settlement.

Moreover, these lawyers aren’t afraid to stand up to insurance companies, advocating passionately on your behalf. Their ultimate goal is to alleviate the stress of the claim process and help you recover the compensation you rightfully deserve.

Battling Insurance Firms For Fair Compensation

Dealing with insurance firms can be a daunting task. They often have a team of expert lawyers and adjusters working to minimize their payouts. This is where the expertise of a Bradenton water damage insurance lawyer becomes crucial. They are well-versed with the tactics employed by insurance firms and can counter them effectively, ensuring that you receive the compensation that truly reflects your loss.

Finding The Right Water Damage Insurance Lawyer In Bradenton

Local Expertise And Proven Success

When selecting a water damage insurance lawyer, it’s vital to choose one with experience and success in handling similar cases. Local lawyers who have dealt with Florida-specific water damage claims are better equipped to understand the intricacies of your case and provide effective legal counsel.

Personalized Approach For Bradenton Residents

The best water damage insurance lawyers in Bradenton take a personalized approach, providing individualized attention to each case. They acknowledge the unique circumstances of your claim and work closely with you to develop an effective legal strategy. This hands-on approach helps ensure that your claim is not just another number in a long list, but receives the dedicated attention it deserves.

Frequently Asked Questions Pertaining To Bradenton’s Water Damage Insurance

Q: Why Is Flooding Not Typically Covered By Standard Insurance Policies In Florida?

A: In Florida, standard insurance policies usually exclude flooding due to the high risk associated with it. Insurance companies categorize flooding as a separate risk. Therefore, to cover flood damage, property owners need to purchase a separate flood insurance policy, which is often overseen by the National Flood Insurance Program (NFIP).

Q: What Is The Role Of Photographs And Detailed Notes In A Water Damage Insurance Claim?

A: Photographs and detailed notes play a crucial role in documenting the extent and nature of the water damage. These records serve as evidence when submitting your claim to the insurance company. They help in establishing the authenticity of your claim and assessing the true extent of damage, which is essential for determining the compensation amount.

Q: Why Is It Necessary To Hire A Water Damage Insurance Lawyer For An Insurance Claim?

A: Hiring a water damage insurance lawyer can be beneficial for several reasons. They bring in-depth knowledge of insurance laws in Florida, expertise in negotiating with insurance companies, and experience in handling similar cases. Lawyers expertly navigate the claims process, help in properly documenting the damages, and counter any tactics employed by insurance companies to minimize payouts.

Q: How Does A Personalized Approach Benefit My Water Damage Insurance Claim?

A: A personalized approach ensures that your unique circumstances and needs are taken into account while handling your claim. It allows the lawyer to understand the intricacies of your case, develop a tailored legal strategy, and ensure that your claim gets the dedicated attention it deserves, thereby increasing the likelihood of a fair settlement.

Q: Why Should I Choose A Local Bradenton Water Damage Insurance Lawyer?

Choosing a local Bradenton water damage insurance lawyer is advantageous as they have a deep understanding of Florida-specific insurance laws and the local conditions that often contribute to water damage. They are familiar with local insurance companies and their tactics, and have experience in effectively countering these to ensure a fair settlement for their clients.

Schedule A Consultation With Our Water Damage Insurance Lawyers

Don’t let the stress of a water damage insurance claim overwhelm you. Our team of experienced and dedicated lawyers in Bradenton is here to help. We provide expert legal counsel, personalized attention, and relentless advocacy to ensure that your rightful compensation is not compromised by insurance companies. Call (727) 821-3195 today to schedule a free consultation and let us fight for your rights as a property owner in Florida.

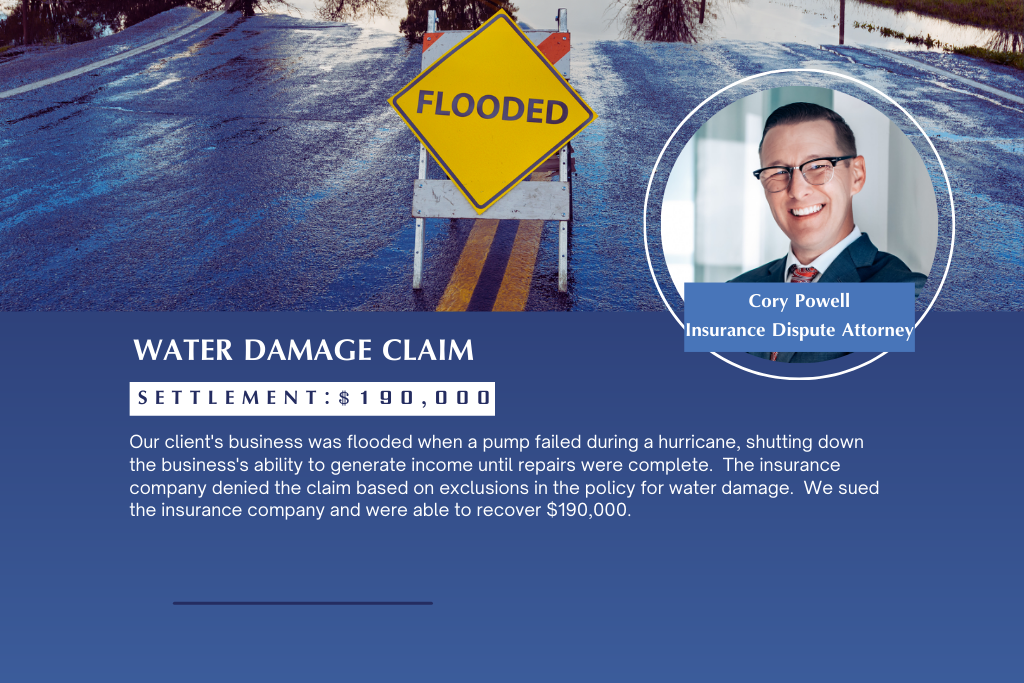

Case Results

See More Case ResultsDenied Claim for Septic Tank Backup

Soon after buying their home, our clients had water that backed up from their septic system into their house, damaging their floors and walls. The insurance company denied the claim and later tried to limit the homeowners’ recovery to just $5,000 because of a sewer backup clause in the insurance policy. We argued the issue before the court and won. Shortly before the case was going to be tried, we were able to resolve the claim for $130,000.

Initial Position

Claim Denied

$130,000.00

Denied Water Damage Claim

Our client’s business was flooded when a pump failed during a hurricane, shutting down the business’s ability to generate income until repairs were complete. The insurance company denied the claim based on exclusions in the policy for water damage. We sued the insurance company and were able to recover $190,000.